All Year Management may face more trouble on the horizon as the outlook for its two unsecured bond series, and the company as a whole, were downgraded to negative by Israeli rating agency Midroog on Tuesday.

At the same time, the agency has placed All Year’s two secured bond series under review for upgrade, as Yoel Goldman’s firm mulls a possible sale of the underlying properties — although two bondholder votes on Monday may have complicated matters.

“The negative outlook reflects the attrition in the company’s level of leverage beyond Midroog’s predictions, and the small improvement in the debt-to-EBITDA ratio,” a rating document published on the Tel Aviv Stock Exchange Tuesday stated. “Our assessment is that the company is dependent, among other things, on the realization of properties in order to maintain solvency, in light of the deterioration of access to capital markets and limited financial flexibility.”

A day prior, holders of All Year’s Series C bonds (backed by the William Vale hotel) and Series E bonds (backed by phase one of the Rheingold Brewery development) voted on two amendments to the terms of early payment of those bonds, in the case of a sale or refinancing of their respective underlying properties.

According to the original bond terms, the amount All Year would have to pay could be determined by a complex formula involving future cash flows and the returns of government bonds. With the amendments, All Year sought to simplify the calculation to only pay the remaining principal and interest on the bonds, plus a 1 percent penalty.

The votes had originally been scheduled for Dec. 17, but were repeatedly postponed in the following weeks.

Both proposals, which required a supermajority of two-thirds to pass, were rejected. Series C bondholders rejected the amendment by a slim margin, with 63.05 percent of the vote in favor, while the amendment for Series E was roundly dismissed, with just 1.07 percent of the vote cast in support of the proposal.

Representatives for All Year did not respond to a request for comment.

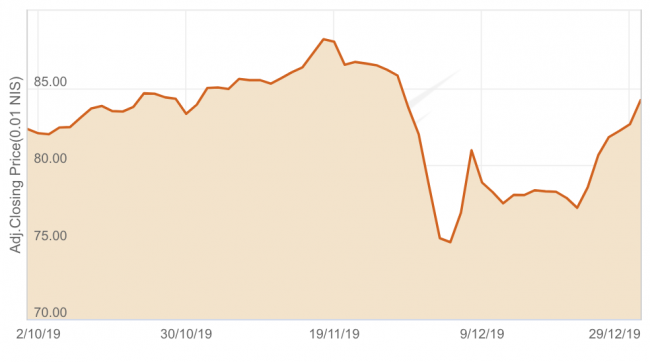

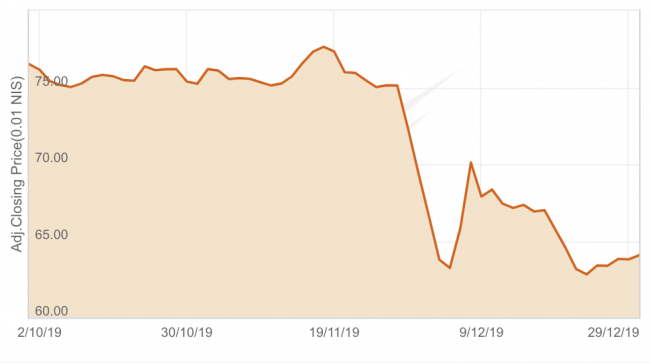

All Year’s bond prices, which crashed in early December following a concerning earnings report and a $40.8 million third-quarter loss, had a mixed response to recent events. After weeks of volatility, the company’s Series B, C and E bonds have all mostly risen back to the level they were at in November, while the Series D bonds — long the company’s worst-performing series — continues to hover below 65 cents on the dollar.