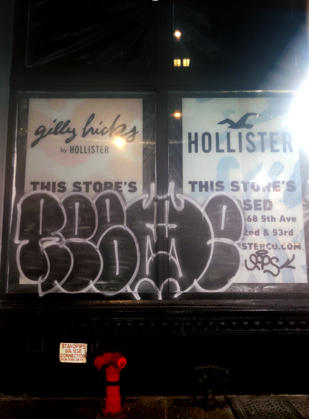

Less than a year after the Hollister flagship store at 600 Broadway in Soho shut down, the posters announcing the closure are covered in graffiti. On the other side of the through-block property, ripped signs on the windows tout the upcoming launch of a TruFusion fitness studio — in fall 2018. And a 24-Hour Fitness sign declares: “The city never sleeps. Neither do we.”

In reality, the gym shut out the lights in 2018. In fact, all the building’s retailers have left. Some have been gone for years.

Photos of the vacant space (credit: Kevin Sun)

Yet the six-story, 77,280-square-foot building remains 100-percent leased and pulls in more than $10 million in annual rent, according to disclosures from its $120 million CMBS refinancing in 2016.

Retailer Abercrombie & Fitch is locked into a 20-year lease that lasts until 2028. “We’re willing to walk away from any mall at this point,” the company’s chief financial officer Scott Lipesky said at a conference Monday. But generally its departures occur when the lease expires. At 600 Broadway Abercrombie & Fitch has to keep paying rent.

The CMBS loan was recently transferred to a special servicer for the second time in a year, but not because of any issues with the property’s finances. Because of restrictions in the loan’s terms, the landlords have had to take this somewhat peculiar step to bring some life back to the building.

Receiving rent for an empty building might seem like a sweet deal, but the landlords of 600 Broadway — Bobby Cayre’s Aurora Capital Associates, Alex Adjmi’s A&H Acquisitions and the Chera family’s Crown Acquisitions — are seeking to modify the loan terms so they can terminate 24 Hour Fitness’ lease three years early and put a new tenant in its 30,279 square feet, according to a report Tuesday by Kroll Bond Rating Agency.

Photos of the vacant space (credit: Kevin Sun)

A representative for the landlords declined to comment. The real estate division for 24 Hour Fitness did not respond to a request for comment. Nor did TruFusion, a group fitness and yoga brand backed by baseball star-turned-real estate investor Alex Rodriguez, which subleased a portion of 24 Hour Fitness’ space for a studio which appears to have never opened.

The loan’s first stint in special servicing, which lasted from last April to August, was an opportunity for Aurora and partners to resolve some other tenant issues. Abercrombie & Fitch, Hollister’s parent company, had decided to close the Soho flagship, and agreed to prepay $8 million in rent for permission to go dark.

A&F’s tenancy at the building consists of 30,509 square feet for Hollister and 8,245 square feet each for Abercrombie & Fitch and lingerie brand Gilly Hicks, both of which have been dark since at least 2016.

The long-term Hollister lease, for what would be the brand’s first flagship, was inked around 2008 — the year the economy imploded — when Aurora, A&H and Crown acquired the property from Olmstead Properties for $71.4 million. Its departure from the lease a decade later was clearly a painful one.

“The majority of potential future closures are expected to occur primarily through natural lease expirations,” Abercrombie & Fitch’s CEO Fran Horowitz said on the firm’s second-quarter earnings call last year. “The exercise of kick-out clauses provided in our leases, accelerated by us for exercising go-dark provisions, as we recently did with our Soho store, should be the exception.”

By some accounts, Abercrombie had wanted out of the Soho space for years. The retailer was reported to be seeking a subtenant for the Hollister space as early as 2013. It is unclear if any subtenants might yet move in.

Prospective tenants at 600 Broadway will have to consider that ground-floor retail use is illegal in many Soho buildings, despite the neighborhood’s emergence as a retail destination.

The property has also lost the benefit of one of its bigger draws for passers-by: a giant side wall with the Hollister logo painted on it, which historically served as an informal welcome sign to Soho and was immediately visible to passengers exiting the Broadway-Lafayette subway station.

Last year Vornado Realty Trust and Madison Capital finished erecting a six-story office-and-retail building directly in front of that wall, at 606 Broadway.

The blockage of the billboard did not help Hollister’s bottom line, but sales had been struggling for quite some time. An appraisal from the time of the building’s refinancing noted that the flagship pulled in just $126 per square foot in annualized sales in 2015, less than a third of the retailer’s national average of $391. Construction on Vornado and Madison’s building had already begun at that time.

Apparently, things got so bad for the Abercrombie & Fitch store that the company preferred to rent the space empty.

“These decisions are difficult, but we have a comprehensive process in place that evaluates many factors,” Horowitz told investors on the earnings call, noting factors such as the condition of the store and preferred long-term market positioning, as well as operating costs and lease terms. “For Soho, we checked all of the boxes that supported closure.”

David Jeans contributed reporting.