The real estate investment trust that posted the strongest returns last year doesn’t own any buildings — just $2.7 billion worth of land underneath them.

Safehold, the ground lease REIT managed by iStar, saw total stock returns of 118 percent in 2019, the firm announced Thursday morning in its fourth-quarter earnings, while the company’s portfolio grew by 187 percent over the same period. Revenue increased 88 percent to $93.4 million while net earnings rose 136 percent to $27.7 million.

Its stock price was hovering around $52 a share as of early afternoon; it was just $17.81 at the start of 2019.

“We made a lot of progress in 2019, taking Safehold from just a theory to a tangible, growing business,” president and chief investment officer Marcos Alvarado said on the call with analysts and investors. The company was formed in 2017 as “Safety, Income, Growth” with an initial portfolio of $339 million in ground leases that iStar had accumulated over the years. It rebranded as “Safehold” last February.

Alvarado noted he believes Safehold has “only scratched the surface” in terms of gaining traction among both investors and property owners.

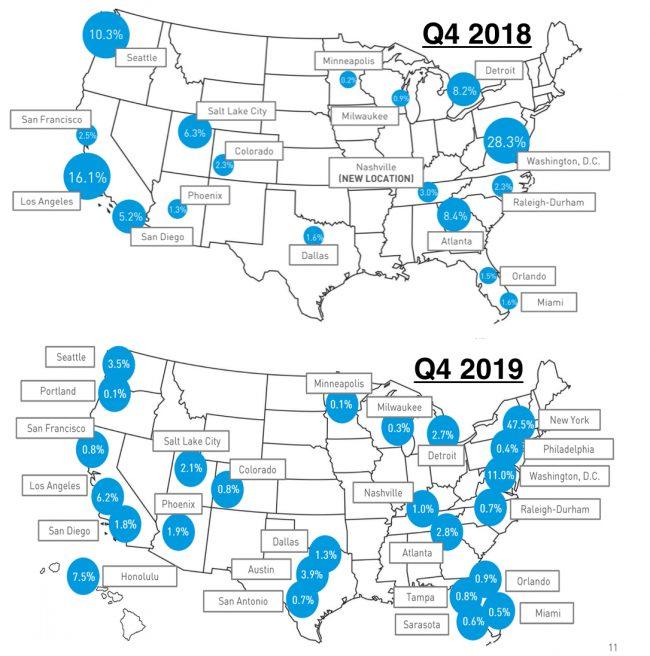

The company’s efforts to “educate the market” got a big boost in 2019 thanks to a handful of large deals in New York City. While Safehold did not own any ground leases in the five boroughs a year ago, the city now accounts for 47.5 percent of its national portfolio.

“Our new modern ground lease… has now proven to be the right solution for a wide variety of high-quality owners of high-quality real estate,” chairman and CEO Jay Sugarman said on the call.

iStar and Safehold also announced Thursday that McKinsey & Co.’s alum Jeremy Fox-Geen would be joining both firms as chief financial officer.

Read more

Geographic distribution of Safehold’s portfolio at the end of 2018, vs. the end of 2019 (Credit: Safehold)

New York, New York

The REIT’s New York City buying binge began in August, when it announced it would be buying the existing ground lease under L&L Holding Company’s office development at 425 Park Avenue for $620 million. A sovereign wealth fund was brought into the deal, with Safehold retaining a 55-percent stake.

A month later, Safehold agreed to create a new $275 million ground lease underneath 195 Broadway in the Financial District, as part of a deal which saw L&L Holding and a group of Korean partners acquire the 29-story building from JPMorgan’s asset management arm.

The company continued its streak in the following months, paying $285 million for a ground lease under 135 West 50th Street, and then $180 million for a ground lease under 685 Third Avenue.

“Volume in the fourth quarter was substantially above our expectations,” Sugarman said.

National scope

Nationally, the firm broke into the Hawaii market by picking up an existing ground lease under the Alohilani Resort in Waikiki Beach for $195 million. Other new markets included Austin, Tampa, Florida, Philadelphia and Portland, Oregon.

Safehold is on a self-described mission to revolutionize the $7 trillion commercial real estate industry by unlocking the value in the ground under almost any asset.

The REIT’s ground leases are structured very differently from traditional ground leases owned by institutions and rich families, whose “fair-market resets” have recently created major headaches at properties such as the Chrysler Building and Lever House.

“Fair-market value is a lose-lose, which creates uncertainty that buyers don’t like and lenders don’t like, and doesn’t do anybody any good,” Sugarman said of such legacy ground leases.