When a Bronx real estate investor raised questions last month about All Year Management’s Rheingold Brewery development, bondholders in Tel Aviv appeared to respond with a collective shrug.

Now things are getting serious.

Toot Food Industries Ltd., an Israeli candy manufacturer that holds a short position on All Year’s Series E bonds, filed a legal action in Tel Aviv Sunday against Yoel Goldman’s firm. Toot Food is asking the district court to declare Brooklyn-based All Year and trust company Mishmeret to be in violation of Israeli securities law.

The suit is asking the court to declare that All Year is in violation of Israeli securities law and give its bondholders back the building rights at 54 Noll Street, a 433-unit project that marks the first phase of Denizen Bushwick. That first phase is the collateral for All Year’s Series E bonds.

“The matter of this motion is absolutely simple — to return building rights that belonged to [54 Noll Street] and which were illegally removed from the collateral that was given to the company’s bondholders,” the motion states.

Toot Food shares a U.S. office address with Bronx landlord Chestnut Holdings; Ardon Wiener of Chestnut raised the questions about the All Year development last month.

In correspondence obtained by The Real Deal last month, Wiener pointed out several alleged irregularities in All Year’s property records, including an undisclosed development rights transfer, a misplaced signature, and a conflict of interest caused by All Year and Mishmeret’s use of the same Brooklyn attorney.

All Year has rejected these claims, and reiterated its stance in a response Sunday.

“This is another futile attempt by entities holding a short position in the company’s bonds to damage the company and its bondholders through unfounded and baseless claims,” the company said. It added that all of its collateral had been fully registered in accordance with the law.

A correction has been filed for the mortgage document that contained an incorrect signature, property records show.

In a separate disclosure on Sunday, All Year also announced that it had entered an agreement to sell a massive portfolio of Brooklyn multifamily properties for $344 million to an unrelated party. The 74-building portfolio includes 611 residential units and 18 commercial units, and the firm expects positive cash flow of about $59 million after loans on the properties are paid off. Henry Bodek of Galaxy Capital brokered the deal. He declined to comment.

All Year announced last month that it had signed a non-binding agreement for a $675 million refinancing of the Denizen Bushwick, which would allow it to pay off the Series E bonds. The firm is also seeking a sale or refinancing of the William Vale hotel and office complex in Williamsburg to pay off its Series C bonds.

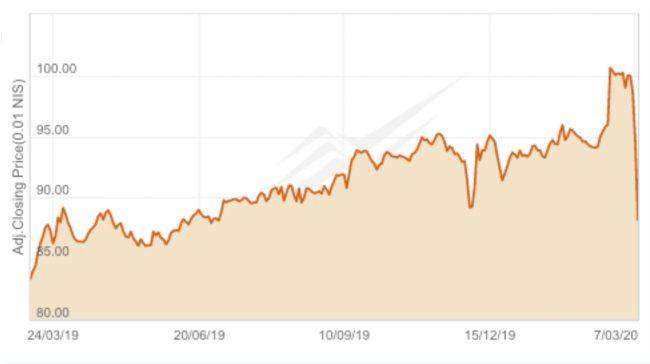

In line with the worldwide stock market selloff, bonds prices in Tel Aviv have fallen dramatically over the past two days, and the Tel Bond Global index — which tracks non-Israeli bond issuers, including U.S. real estate firms — has seen a 9 percent decline since Friday. All Year’s bonds have fallen by a similar amount, and it is unclear how investors are reacting to the firm’s latest disclosures.

All Year Series E bond prices over the past year. (Source: TASE)

Read more