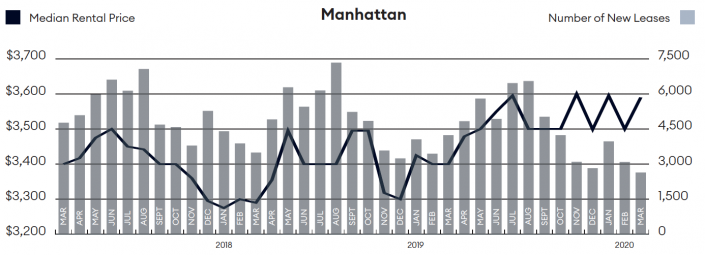

As the pandemic surged across the city last month, the rate of new residential leases in Manhattan, Brooklyn and Queens fell to record lows.

The 37 percent drop in Manhattan was the second largest annual decline in new leases in more than 11 years, according to a market report by Douglas Elliman. On the sales side, new contracts also fell sharply at the end of the month.

The effect of the pandemic was multilayered, according to appraiser Jonathan Miller, who authored the rental report. In late March, brokers were barred from conducting in-person showings, meaning they could only offer virtual tours to prospective tenants.

Then, for those renters who did find a home, the logistical challenges of moving during a pandemic threatened to jeopardize deals. Miller said he’s heard anecdotal reports of several buildings across the city blocking move-ins out of concern about spreading the virus — despite the state’s classification of moving companies as an essential service.

Read more

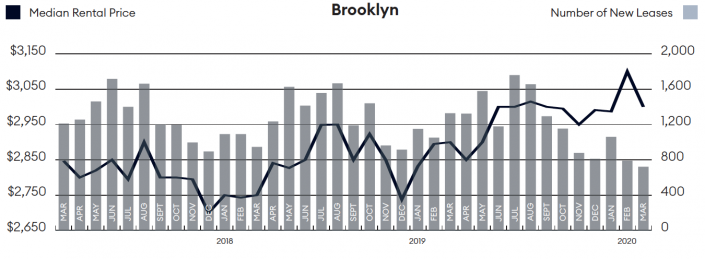

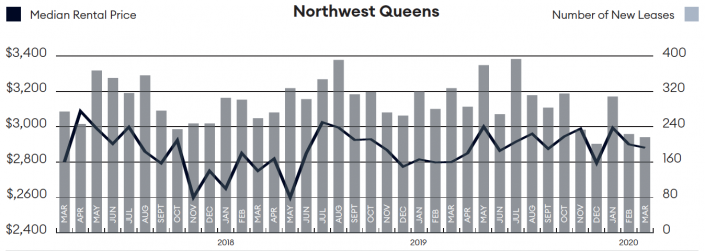

In Brooklyn, the number of new lease signings was the lowest in four and a half years — down 45.7 percent to 721. In Queens, the number dropped 20.4 percent to 223.

At the same time as new leases were tumbling, rents in all three boroughs were on the rise. In Manhattan, the median rent price rose by 5.6 percent to $3,590. In Brooklyn, it was up 3.4 percent to $3,000. And in Queens, the median rent rose 2.9 percent to $2,881.

“You ask yourself, how’s that possible in this environment?” Miller said. “I think the pricing data like that probably lags.”

Throughout the past year, rents have been rising in New York — a response to the soft sales market — and the latest figures reflect that momentum, rather than the effect of the pandemic, he elaborated.

“I would be surprised if we saw much more rent growth going forward,” he said. But, he cautioned, that did not necessarily mean there would be a drop.

Write to Sylvia Varnham O’Regan at so@therealdeal.com