In response to the economic upheaval caused by the coronavirus, central banks around the world have cut interest rates to historic lows. Following a quarter-point rate cut in early March, the U.S. Federal Reserve cut rates by a full point to near zero in mid-March.

After the initial rate cut, many in the mortgage industry predicted a gold rush of originations. But the economic slowdown has complicated the picture, with loan applications for home purchases falling to the lowest levels since 2015 last week. Unlike purchases, however, mortgage refinances still seem to be in a better position to benefit from low rates — as forecasts from the Mortgage Bankers Association indicate.

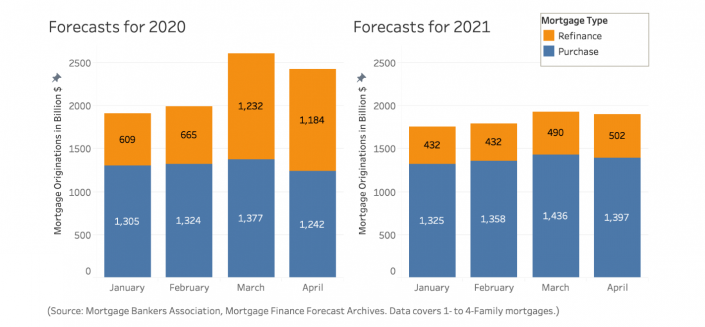

In February, prior to the rate cuts, the MBA forecast nearly $2 trillion in one- to four-family mortgage originations for the whole of 2020, of which about a third would be refinanced mortgages. In March, the projected volume of purchase deals remained more or less flat, while refinance volume spiked to nearly half of the total. In April, forecasted volume for both purchase and refinance mortgages declined slightly as the severity of the crisis set in.

Meanwhile, MBA’s forecasts for 2021 have remained relatively unchanged, with an expected pullback in total volume and with refis accounting for about a quarter of originations.

MBA Mortgage Forecast

| Year | Month | Total | Purchase | Refinance |

|---|---|---|---|---|

| 2020 | January | 1,914 | 1,305 | 609 |

| 2021 | January | 1,757 | 1,325 | 432 |

| 2020 | February | 1,989 | 1,324 | 665 |

| 2021 | February | 1,790 | 1,358 | 432 |

| 2020 | March | 2,609 | 1,377 | 1,232 |

| 2021 | March | 1,926 | 1,436 | 490 |

| 2020 | April | 2,426 | 1,242 | 1,184 |

| 2021 | April | 1,899 | 1,397 | 502 |

Source: Mortgage Bankers Association, April Economic Forecast Commentary

“Our baseline forecast is for a V‐shaped recovery: We expect a sharp drop in growth in Q2 2020, with a recovery late in 2020 and into 2021,” MBA noted in its April commentary to its forecast. “There remains the possibility of a U-shaped recovery as well, with things staying worse for longer as the ripple effects from business closings, restricted in-person activity, and job losses linger, before a steep bounce-back beginning later in 2021. The success of the public health measures in place and planned for the months ahead will make the difference in these paths.”

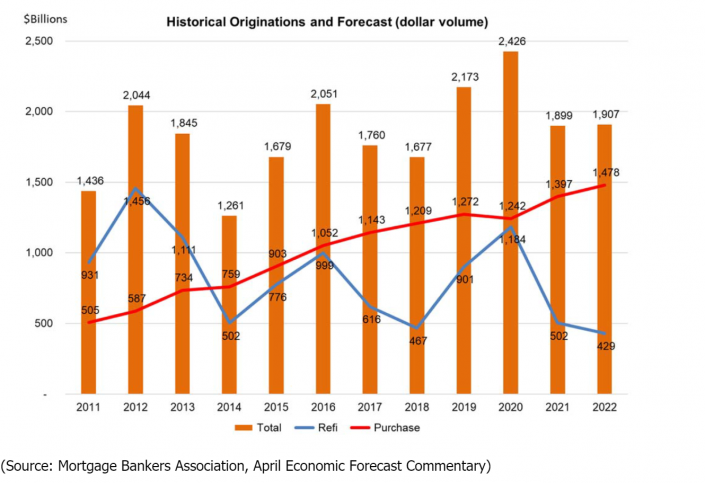

A broader historical perspective shows the volume of home purchases mortgages has steadily increased over the course of the economic expansion that followed the Great Recession, while refi volume has exhibited several peaks and valleys in response to Fed rate changes.

(Source: Mortgage Bankers Association, April Economic Forecast Commentary)