Tenant organizers in New York and Philadelphia are pushing for a mass rent strike on May Day.

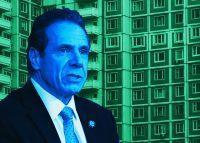

New York tenant coalition Housing Justice for All is aiming to organize 1 million renters to withhold their rent in a bid to compel Gov. Andrew Cuomo to cancel rent and mortgage payments.

The Philadelphia Tenant Union is launching a similar effort after its members voted in favor of a citywide rent strike. They demand a “cancellation of rent for the duration of the crisis,” said its rent-control campaign leader, Karen Harvey, referring to the coronavirus pandemic.

“Tenants are up against the wall,” said Jonathan Westin, executive director of advocacy group New York Communities for Change, adding that rent relief needs to be paired with mortgage relief for landlords. “So we are forcing a confrontation. If millions do not pay their rent, the state will have to step in.”

In New York, to force Cuomo’s hand, tenant organizers envision a two-track rent strike strategy, said Cea Weaver, who is helping to coordinate the campaign. One track will marshall tenants who are unable to pay into a collective action. The other will target “key landlords and buildings” — notably those with ties to Cuomo — with rent strikes.

“We are trying to get the millions of people who are already not paying rent to do that together,” said Weaver. About 16 percent of tenants did not pay rent in the two weeks ending April 12.

Organizers declined to specify which landlords or buildings they would target.

Tenant organizers say New York’s three-month moratorium on evictions is inadequate. They say without more government relief, those who are unable to pay will face eviction in a few months.

The economic shutdown prompted by the coronavirus has left an unprecedented number of people without jobs. More than 791,000 have applied for unemployment benefits in New York since mid-March, according to the state’s Department of Labor, and more than 1 million in Pennsylvania.

Read more of our coverage on housing policy amid the global health crisis

A study by the New School estimates that the coronavirus has cost New York City 1.2 million jobs and predicts the city’s unemployment rate could reach 30 percent.

Federal stimulus checks, which the Treasury Department began sending this week, would cover a month of housing costs for just 77 percent of renters across the U.S. and are subject to garnishment by creditors before they reach individuals.

New York enacted the eviction moratorium in mid-March and threatened state-chartered lenders that do not grant forbearance to homeowners unable to make mortgage payments because of the pandemic. Some landlords are getting forbearance on mortgages insured by Freddie Mac — a program which was extended through the end of the year. New York’s top multifamily lender offered similar lenience to its borrowers.

According to one large multifamily landlord who requested anonymity to speak candidly, other major multifamily lenders in New York City are following suit with relief that is “as good or better” than what the federal housing agency is offering.

Although a survey of 11.5 million professionally-managed apartments found 84 percent of tenants paid at least some rent in early April, that may not be the full picture, according to Marcus & Millichap broker Peter Von der Ahe.

Landlords in some New York City neighborhoods collected only 60 percent of their normal rent, he said. And Bronstein Properties, which owns 5,000 mostly rent-stabilized units in the city, said current rental collections were “down significantly” in April.

As unemployment continues to rise, landlords are concerned that May’s collections will be much worse than April’s — which is now a goal of tenant organizers.