As millions of homeowners face financial distress as a result of the coronavirus crisis, their efforts to work things out with mortgage lenders have run into a logistical bottleneck: call center capacity.

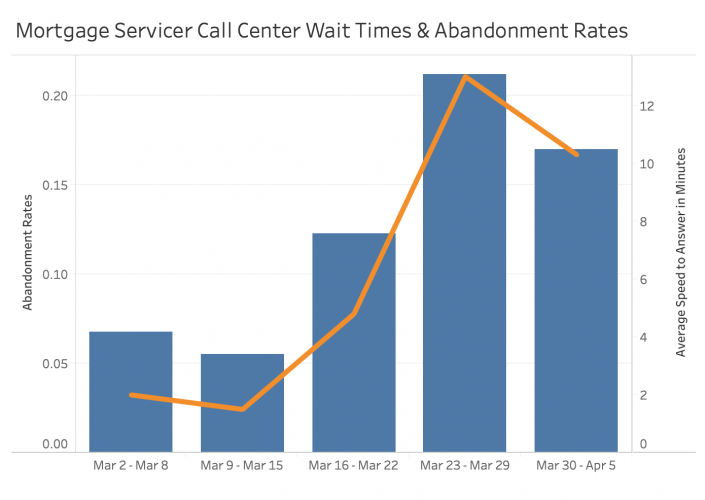

Call center wait times have ballooned as the crisis took hold, leading more people to hang up early, according to data from the Mortgage Bankers Association. And the calls, once they do get through, have also become longer.

Mortgage Bankers Association Call Volume Survey Results

TABLEPRESS CODE:

| Week | Average Speed to Answer in Minutes | Abandonment Rates | Handle Times in Minutes |

|---|---|---|---|

| March 2 - March 8 | 2 | 6.75% | 6.4 |

| March 9 - March 15 | 1.5 | 5.54% | 6.3 |

| March 16 - March 22 | 4.8 | 12.28% | 6.6 |

| March 23 - March 29 | 13 | 21.23% | 7.3 |

| March 30 - April 5 | 10.3 | 17.01% | 7.5 |

SOURCE: Mortgage Bankers Association

Call volume started to pick up the week of March 16, when wait times more than doubled from 1.5 minutes to 4.8 — leading 1 out of 10 callers to give up before speaking to a representative. Wait times ballooned to 13 minutes the following week, leading as many as one in five callers to hang up before being connected. The average length of calls has also increased by about a minute.

By the turn of the month, wait times had declined slightly — but certainly not because there were fewer people in need of mortgage forbearance. According to MBA senior vice president and chief economist Mike Fratantoni, the decline “indicates the mortgage industry is adapting to the current environment by adding or reallocating staff and increasingly utilizing its websites to help borrowers.”

As of the first week of April, about 3.74 percent of home loans were in forbearance, according to MBA data. That’s up from 2.73 percent the week prior, and 0.25 percent in the beginning of March. And according to an estimate from Moody’s Analytics chief economist, up to 30 percent of homeowners could stop making payments.

Read more from TRD Insights