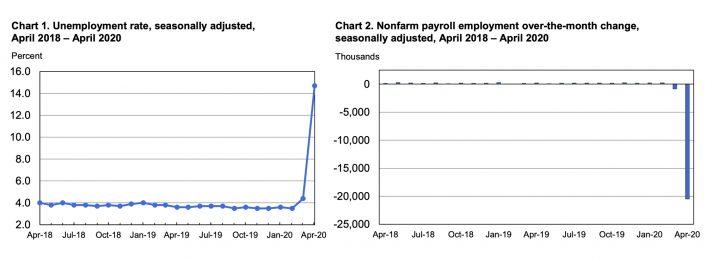

Following an unprecedented 20.5 million drop in payroll last month, the April unemployment rate reached a record 14.7 percent, the U.S. Bureau of Labor Statistics reported Friday.

That figure is the highest unemployment percentage on record, since seasonally adjusted data became available in 1948. The unemployment rate is estimated to have reached about 25 percent in the wake of the Great Depression in 1933, according to the New York Times.

“The changes in these measures reflect the effects of the coronavirus pandemic and efforts to contain it,” the BLS report says. “Employment fell sharply in all major industry sectors, with particularly heavy job losses in leisure and hospitality.”

The leisure and hospitality sector was the hardest hit by social distancing measures and economic turmoil, losing 7.7 million jobs. Among those jobs, about three-quarters were from food services and drinking places (5.5 million). The accommodation sub-sector lost 839,000 jobs while arts, entertainment, and recreation lost 1.3 million.

The retail sector lost 2.1 million jobs, about a third of which were from clothing and clothing accessories stores. Meanwhile, “general merchandise stores” including “warehouse clubs and supercenters” gained 93,000 jobs as some large retailers have ramped up hiring amid the pandemic.

Construction employment fell by 975,000, including 691,000 specialty trade contractors and 206,000 building construction jobs.

Read more

The unprecedented level of unemployment is expected to have an impact on the entire real estate ecosystem, from renters and landlords to lenders and investors.

“The early impact of this deterioration on the mortgage market has already been felt by rapidly increasing rates of loans in forbearance,” Joel Kan, head of economic and industry forecasting at the Mortgage Bankers Association, said in a statement. “We expect that a rising share of loans will continue to be put into forbearance, putting further liquidity stresses on mortgage servicers.”

One positive note for the industry, Kan noted, is that home-purchase loan requests have risen for three straight weeks amid historically low mortgage rates.

Another possible bright spot: Among the 23.1 million unemployed, 18.1 million were categorized as being on temporary layoff, indicating a readiness to return to work soon.

States have begun putting together plans for an eventual reopening of the economy, and hotels in states like Texas and Florida have already seen an uptick in occupancy. Mall owners and operators have also announced plans for reopening.

Meanwhile, things are likely to get worse before they get better. American workers filed another 3.2 million jobless claims last week, pushing the total to 33.5 million applications in the seven weeks since coronavirus lockdowns began.