The share of home loans in forbearance grew again last week while relief requests slowed, according to weekly figures released Monday by the Mortgage Bankers Association.

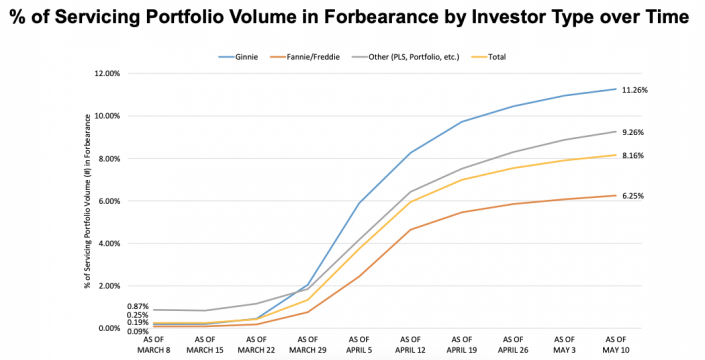

Mortgages in forbearance made up 8.2 percent of servicers’ portfolios for the week. That was up from 7.9 percent for the week ending May 3 and 7.6 percent for the week before that.

The pace of forbearance requests has dropped, however. Such requests accounted for 0.32 percent of servicing portfolio volume, marking the fifth consecutive weekly drop. The week prior, forbearance requests accounted for 0.51 percent of volume.

“There has been a pronounced flattening in loans put into forbearance — despite April’s uniformly negative economic data, remarkably high unemployment, and it now being past May payment due dates,” MBA Chief Economist Mike Fratantoni said in prepared remarks.

Ginnie Mae-backed mortgages had the highest overall forbearance rate by investor type at more than 11 percent. Ginnie Mae guarantees home loans issued to lower-income borrowers by government agencies such as the Federal Housing Administration and Veterans Affairs. FHA and VA borrowers are more likely to work in industries hit hard by the coronavirus pandemic, such as hospitality and retail, Fratantoni said.

Fratantoni added that weekly growth in refinancings and home purchase applications coupled with the drop in forbearance requests could signal that the housing market is on the path to recovery as states gradually reopen their economies.