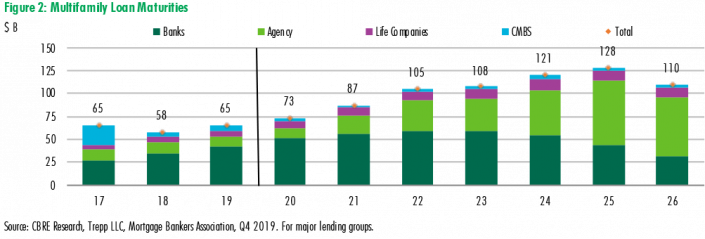

A recent analysis found an estimated $73 billion in multifamily loans will mature this year, up nearly 12 percent from 2019.

But that total pales in comparison to the expected multifamily loan maturities over the next five years, according to the data from CBRE’s analysis of Trepp and Mortgage Bankers Association.

In 2021, maturities will reach $83 billion, and they will keep rising, peaking in 2025, when $128 billion in multifamily loans will mature.

Loan maturities drive investment and financing activity because they often push borrowers to sell assets, seek new financing or refinance their original loans to avoid default.

Maturities during economic crises like the coronavirus can heighten the risk for multifamily borrowers and lenders, however. These events often send multifamily operating incomes tumbling, which may make it harder for borrowers to obtain loan modifications or refinancings and may increase their default risk.

Lenders also typically raise underwriting standards during financial crises, only issuing loans secured by assets with solid net operating incomes and loan-to-value ratios.

A silver lining is that the biggest multifamily lenders are fairly well-capitalized, and may be able to absorb substantial losses related to defaults on loans.

Banks and government sponsored entities such as Fannie Mae and Freddie Mac originated the bulk of multifamily loans maturing over the next decade. Banks’ “loss-absorbing capacity” reached historically high-levels at the end of 2019. That allowed them to continue lending despite the coronavirus pandemic-related shocks the market is now experiencing, according to a report last week the Federal Reserve published on the stability of the U.S. financial system.