The volume of commercial real estate deals fell to the lowest level in a decade, according to a new report.

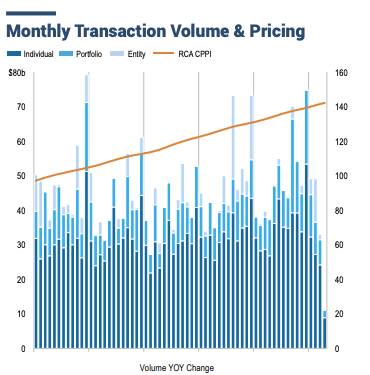

Deal volume totaled $11 billion in April, a 71 percent year-over-year drop, according to commercial real estate data provider Real Capital Analytics. The number of deals, meanwhile, has fallen an average of 36 percent since January, but saw a drop of 61 percent between March and April.

Although some property types fared better than others, not one ended the month on a high note. Hotel sales descended to $5.1 billion, their lowest level since RCA started recording transactions. The office and industrial sectors performed the “best,” but each still notched a 60 percent drop in transactions.

Entity-level, or company sales, and portfolio trades saw deal volume contract by 80 percent year over year. The report notes that the freeze on mergers and acquisitions will continue until the market stabilizes — or until more distressed opportunities appear.