Home lending in the United States entered the coronavirus pandemic on solid footing, according to a quarterly report from real estate data provider Attom Data Solutions.

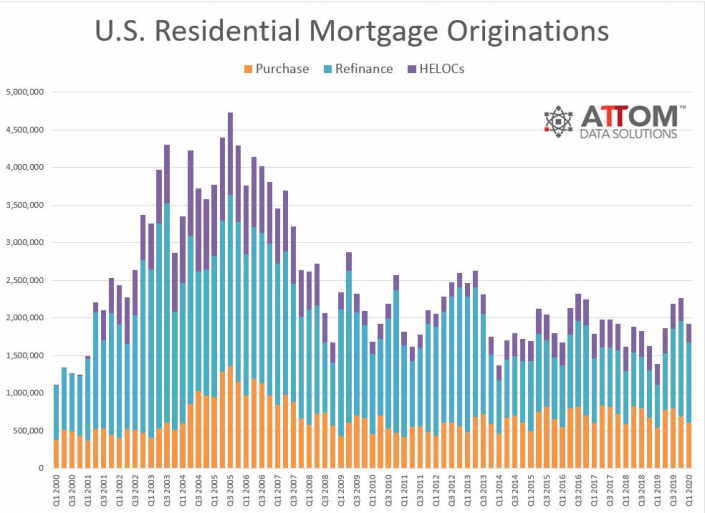

With interest rates hitting all-time lows in the first quarter, refinancings enjoyed the steepest annual growth, and also made up nearly half of all loans originated. Although the dollar volume of refinancings dropped by 16 percent from last quarter, it doubled from last year, reaching $329 billion.

The number of refinancing originations clocked annual gains in nearly all metro areas tracked by Attom. In New York, they grew by 71.2 percent over their level last year. Chicago, Los Angeles, Dallas and Houston also each clocked year-over-year growth in refinancings exceeding 50 percent.

Similar to refinancings, purchase mortgage originations were down from last quarter but up from last year. Purchase mortgage originations dropped 12 percent from Q42019 but increased 13 percent from Q12019, and gained in 62 percent of all metro areas examined by Attom.

Home equity lines of credit were the only loan type that fell annually and quarterly. HELOC mortgage originations dropped 20 percent from the previous quarter and 11 percent from last year.

The share of mortgages backed by the Federal Housing Administration dropped by 4 percent from last quarter and last year, comprising only 12.4 percent of all loans originated. Mortgages backed by Veterans Affairs, however, reached an all time high last quarter, backing 9.2 percent of all loans originated.

The first quarter of 2020 only reflects about two weeks of coronavirus-related market shocks, so these numbers tell little about what’s to come for residential mortgages in the coming months. Still, they show that residential lending was strong before the coronavirus pandemic hit the United States and major mortgage lenders announced they would tighten their lending standards.

More recent data from the Mortgage Bankers Association (MBA) suggest that homebuyers’ appetite is recovering as states move to reopen their economies. Last week, the volume of mortgage applications to purchase homes tracked by the Mortgage Bankers Association grew for the sixth consecutive week.