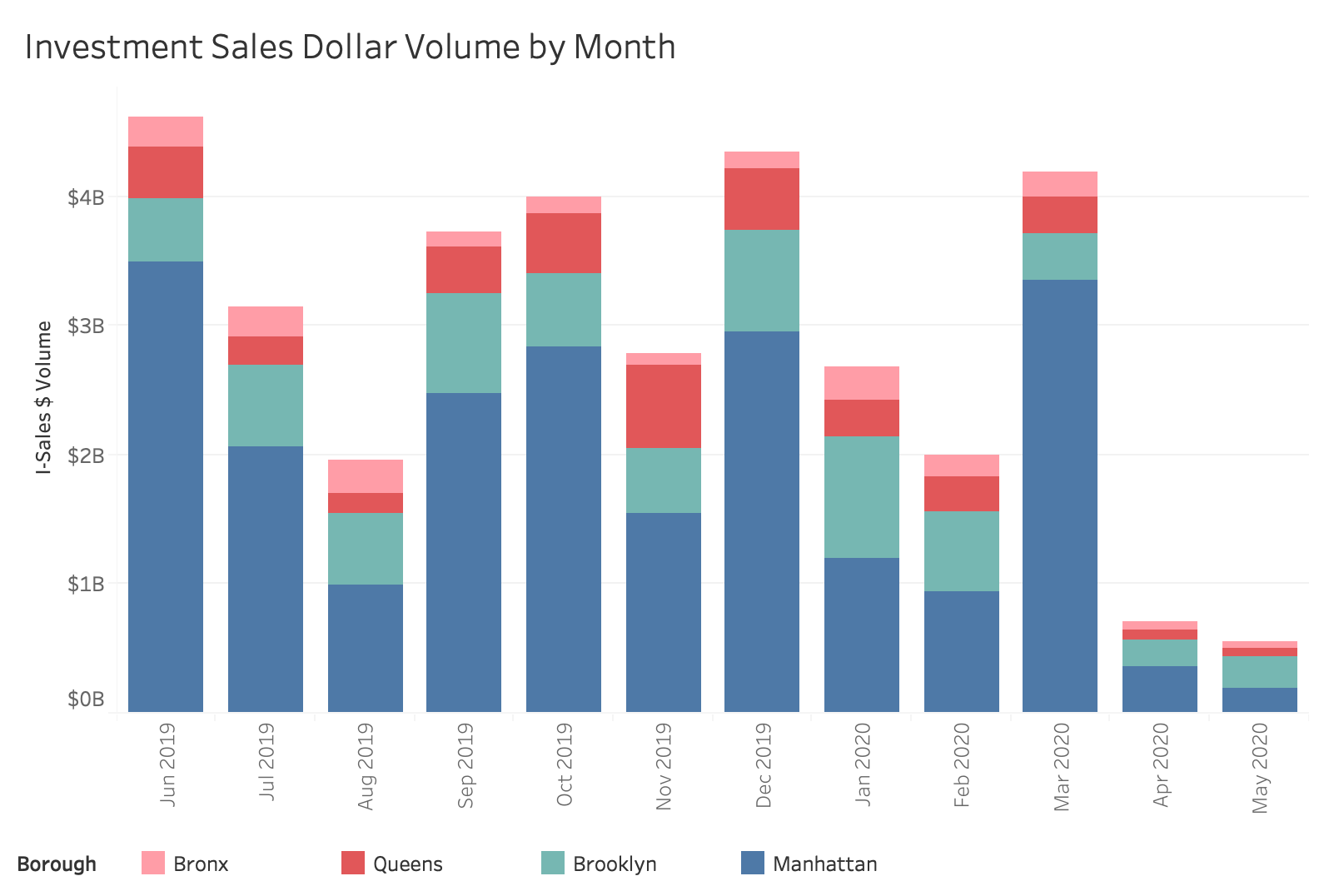

March, what now seems like a lifetime ago, was a banner month for investment sales in New York City. That’s when two $900 million-plus office building sales helped propel total deal volume to over $4 billion, the third-highest sum in the past 12 months.

But that data still largely reflected a pre-Covid world, because of the lag between closings and property record filings, as well as the pipeline of deals that were already in the works.

In April, commercial real estate deals fell to $708 million in deals recorded, down 75 percent from the 12-month rolling average, according to an analysis of property records by The Real Deal. The market continued to slow into May, as deal volume plummeted to $551 million.

Investment Sales Dollar Volume by Borough, Past 12 Months

| Month | Manhattan | Brooklyn | Queens | Bronx | Total |

|---|---|---|---|---|---|

| Jun '19 | $3,488,826,980 | $491,583,486 | $404,936,585 | $228,998,365 | $4,614,345,416 |

| Jul '19 | $2,055,831,903 | $635,526,295 | $225,712,596 | $231,303,826 | $3,148,374,620 |

| Aug '19 | $994,568,763 | $549,667,829 | $163,006,097 | $248,431,610 | $1,955,674,299 |

| Sep '19 | $2,467,687,345 | $778,870,723 | $362,069,402 | $109,441,020 | $3,718,068,490 |

| Oct '19 | $2,830,091,040 | $567,269,046 | $472,470,411 | $121,591,497 | $3,991,421,994 |

| Nov '19 | $1,542,481,247 | $502,925,947 | $643,464,996 | $99,568,914 | $2,788,441,104 |

| Dec '19 | $2,944,526,061 | $793,378,103 | $479,708,549 | $123,976,948 | $4,341,589,661 |

| Jan '20 | $1,192,344,089 | $946,933,659 | $287,534,737 | $258,234,091 | $2,685,046,576 |

| Feb '20 | $941,738,457 | $616,060,878 | $278,359,927 | $159,804,440 | $1,995,963,702 |

| Mar '20 | $3,354,998,451 | $357,237,114 | $286,574,234 | $189,028,549 | $4,187,838,348 |

| Apr '20 | $363,761,356 | $200,824,488 | $79,913,561 | $63,843,667 | $708,343,072 |

| May '20 | $194,605,422 | $245,431,527 | $60,863,297 | $49,603,595 | $550,503,841 |

In March, the deals were enormous. The biggest were Amazon’s $1.1 billion purchase of WeWork’s Lord and Taylor building, and Munich RE’s approximately $900 million acquisition of Abu Dhabi Investment Authority’s 330 Madison.

But April and May saw just one deal larger than $100 million recorded. That was Trinity Place Holdings’ sale of a commercial condominium unit at 77 Greenwich Street. The buyer was the New York City School Construction Authority, which paid $104 million for the property.

Only three other deals surpassed $50 million in April and May, all in Brooklyn: Rockrose Development’s $81 million all-cash acquisition of a development site on the border of Fort Greene and DoBro, Camber Property Group’s $82 million buy of an eight-building Flatbush portfolio, and Fortis Property Group’s acquisition of a Bushwick nursing home for $58.8 million.

Mid-market dealmaking also slowed to a crawl, with several weeks of either just one deal or even zero deals in the $10 million to $30 million range.

The months since the pandemic hit New York have been more notable for the deals that fell through than for the ones that closed.

These include SL Green’s scrapped sale of the Daily News Building to Jacob Chetrit for $815 million, All Year Management’s abandoned sale of a 73-building multifamily portfolio to David Werner for $346 million, and Thor Equities’ $24 million sale of a Flatiron District retail building to Mactaggart Family & Partners. The total value of these abandoned deals is nearly on par with the total volume of recorded deals in the past two months.

See the table below for more details on the largest deals that were recorded from March through May:

Top Four Commercial Real Estate Sales by Borough & Month, Mar-May 2020

SOURCE: The Real Deal analysis of NYC property records (ACRIS)