Exactly one year ago, New York’s real estate industry was facing a crisis. The legislature had just agreed to a tenant-friendly upheaval of rent regulation, and a last-minute call from landlords to Gov. Andrew Cuomo, their long-time ally, had failed to secure his opposition to it.

“I never thought the governor could be the white knight of the real estate industry,” one person who was on the June 12 call said Thursday. “Anybody who did was naive.”

The 12 months since then have provided some clarity about the accuracy of landlords’ predictions that investors would flee New York City, owners would forego needed renovations and tenants would suffer.

Many of these projections had longer timelines; it’s too early to detect, for example, any widespread deterioration of rent-stabilized housing stock. But some professionals say the city’s multifamily market is fundamentally different from before passage of the Housing Stability and Tenant Protection Act of 2019.

“It used to be that investors clamored for the rent-stabilized units in a building because of the upside they offered,” said Daniel Parker, managing director at brokerage Hodges Ward Elliott, referring to the potential to significantly raise rents under the old system. “Now, most investors look at those units as no upside and no opportunity. It’s a big change.”

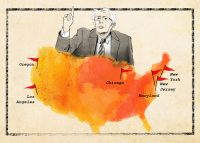

Timothy King, managing partner of brokerage SVN CPEX Real Estate, offered a more withering assessment of the impact on the multifamily market.

“This wasn’t just killing the golden goose,” said King. “This was stomping the poor goose to death and scattering the ashes across the five boroughs.”

Read more

Though the legislative changes were swift, the buying and selling of rent-regulated buildings is not. Tallying the financial toll of the new rent regime may take years.

One of the few quantifiable impacts so far has been a decline in deal volume. Since the law eliminated nearly all pathways to raising rents, large transactions have been rare. The year leading up to the change saw $5 billion in deals involving assets that were more than half rent-stabilized, according to data from Ariel Property Advisors, a brokerage firm that specializes in multifamily properties. In the past year, there were just $1.7 billion.

The steep decline is largely because lenders, operators and investors are still processing the myriad changes and adjusting their practices. The law increased the possibility of legal damages for rent overcharge claims, which led lenders to look under the hood like never before to gauge the risks.

“There is real value attributed to the proper paperwork and the proper maintenance of buildings today,” said Victor Sozio, executive vice president of Ariel Property Advisors, who earlier this year brokered one of the few large multifamily transactions. “If you do not have those two ingredients, you will be discounted accordingly.”

The initial slowdown of large transactions did show signs of easing in January. Yechiel Newhouse purchased the ABJ portfolio in northern Manhattan for $118 million, and TF Cornerstone purchased a $140 million multifamily building in Williamsburg later in the month.

These were only the second and third transactions over $100 million under the new rent law. Then the coronavirus shut down nearly all real estate deals.

The wave of foreclosures that many feared, however, has yet to happen. Borrowers who hadn’t over-leveraged their portfolios with expectations of deregulating apartments and hiking rents continued to service their debt. And even owners who anticipated faster income increases than is now possible have encountered some compassion from lenders.

“You just don’t see banks trying to take buildings back,” said Parker. “There’s no distress because you have an ecosystem of people playing nice with each other.”

While multifamily lenders have demonstrated understanding for existing borrowers, financing new deals faces significant headwinds. Along with scrutinizing the legal liability of each asset, lenders are asking borrowers to come up with far more initial equity than before, and in some cases to put up a deposit of several years’ worth of payments for once-prized assets.

“Loan-to-value ratios are shifting, and now the borrower can borrow less,” said King. “For those looking to refinance who don’t have enough equity, there may not be any for them to take out of the property.”

Another dynamic clouding the financial impact of the new law is the coronavirus, which has prompted many to enter into forbearance agreements with their lenders. New York Community Bank said 9.6 percent of its $31.3 billion multifamily portfolio was in deferral, and Freddie Mac, which insures 21 percent of all multifamily loans, has allowed borrowers to defer payments as well.

The forbearance agreements have been widespread because nearly every property has been affected in some way by the coronavirus. For borrowers who were overleveraged and may have otherwise defaulted in recent months, the opportunity to put off payments was an unexpected reprieve.

“The same people that cut off heat in the middle of the night are the ones who wouldn’t pay their lender, so now those guys are going to pocket the money,” said David Schwartz, principal of affordable housing development firm Slate Property Group. “Even if they’re only collecting 50 or 60 percent of the rent, they’re pocketing the cash and will do better than they would have before the coronavirus.”

However, another form of anticipated relief was disrupted by the pandemic. Many expected the city’s Rent Guidelines Board to allow greater rent increases than usual to make up for the rent law’s elimination of vacancy decontrol, and other changes that restricted when landlords can increase rents on regulated apartments. Instead, the board is poised to freeze rents, following calls by Mayor Bill de Blasio to do so in light of the coronavirus crisis.

But the outlook might not be bleak for those playing the long game. Ofer Cohen, founder and CEO of TerraCRG, said he expects deals to pick up toward the end of the recession, if pricing has adjusted properly. Investors who entered the market with aggressive buyout strategies were hurt the most by the rent law, but those with long-term — say, 10-year — investment plans will find value in rent-stabilized housing, he said.

“It’s like if you walk into the stock market, all these amateurs are coming in, thinking they are going to triple their money, and then they lose,” he said. “And then the professional investors always make money.”