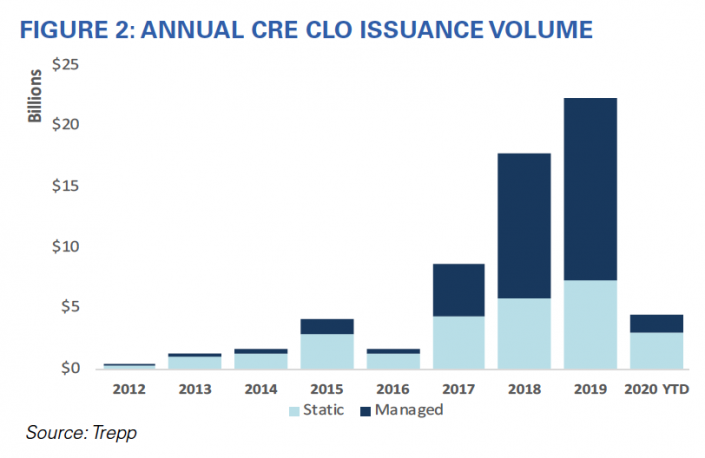

One of the fastest growing segments of the commercial real estate financing space has been commercial real estate collateralized loan obligations. But the strong growth trajectory for CRE CLOs has been cut short by coronavirus as the broader CMBS market has shut down.

Last year, CRE CLO issuance rose to $22.4 billion across 31 deals, according to a new report from Trepp. That was a 26-percent increase from the $17.7 billion across 21 transactions in 2018, which in turn was more than double the total from 2017.

Like its effect on the broader economy, Covid-19’s impact on CRE CLOs has been swift and massive.

“While it is unclear how quickly the CRE CLO market will fully rebound given the unique challenges currently facing the market, it is hard to imagine lenders providing capital for transitional hotel or retail properties in meaningful numbers anytime soon,” the Trepp report observes.

“Considering the unpredictable nature of the current market disruption and that the sector will need time to find its footing, we could potentially see overall issuance volume decline 40% or more from last year’s impressive total.”

Before coronavirus, the first two months of 2020 saw the issuance of four new deals totalling $3.5 billion. The largest of these was Blackstone Group’s $1.5 billion BXMT 2020-FL2 from February, which included portions of massive loans the firm had provided last year on properties like Industry City and Hudson Commons in New York, and 444 North Michigan Avenue in Chicago.

Compared to CMBS conduit loans with 10-year terms, CRE CLOs are often riskier mortgages, such as bridge or transitional loans, with a term of two to three years and one- to two-year extension options. The average coupon on a CRE CLO last year was 160 basis points above the average borrowing rate on 2019’s average CMBS conduit loan, according to the Trepp report.

CRE CLOs that exist today are a revamped version of the “collateralized debt obligations” that became notorious for their role in the 2008 financial crisis.

Unlike that crisis, when the CMBS market went 21 months without a single new deal, current market conditions may allow for a quicker recovery. “Capital is still plentiful and investors are still actively looking for yield as evidenced by the reception of the recently-priced deals,” the report says, noting that two new CRE CLOs totalling more than $1 billion have already hit the market in May and June.

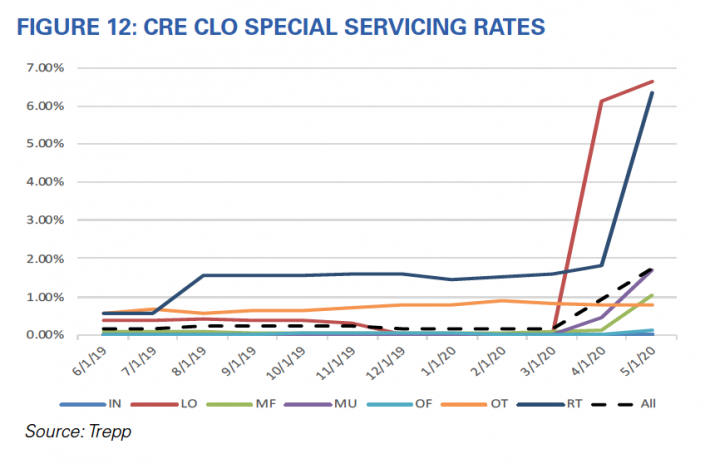

Meanwhile, existing CRE CLOs in struggling sectors like lodging and retail have taken a big hit from the crisis, and more than 6 percent of loans on such properties have been transferred to special servicing.