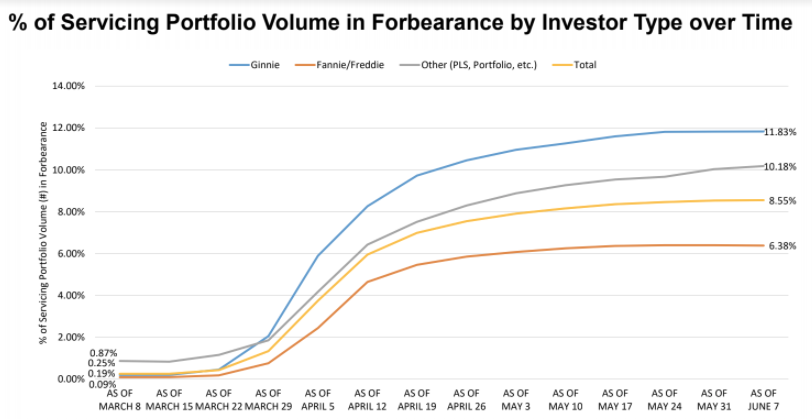

As states reopened their economies and Americans returned to work in the first week of June, the forbearance rate for private label securities and portfolio loans increased 15 basis points to 10.18 percent from 10.03 percent the week prior, driving up the overall share of loans in forbearance.

Ginnie Mae loans in forbearance stayed at 11.83 percent, while Fannie Mae and Freddie Mac loans in forbearance dropped to 6.38 percent from 6.4 percent the week prior, according to figures released by the Mortgage Bankers Association.

Mortgages in forbearance made up 8.55 percent of servicers’ portfolios for the week, up from 8.53 percent for the week ending May 31 and from 8.46 percent for the week before. MBA’s estimate of the number of homeowners in forbearance plans remained basically unchanged from last week at almost 4.3 million.

“Although there continues to be layoffs, the job market does appear to be improving, and this is likely leading to many borrowers in forbearance deciding to opt out of their plan,” MBA chief economist Mike Fratantoni said in prepared remarks.

Still, with June due dates looming, the pace of forbearance requests increased from the week prior for the first time in two months. Forbearance requests grew to 0.19 percent of servicing portfolio volume, up from 0.17 percent.