When Colony Capital revealed in May that it was in discussions with lenders after having defaulted on $3.2 billion in hotel loans, the Tom Barrack-led firm cautioned “there can be no assurances that the company will be successful in such negotiations.” In fact, at the time the Los Angeles-based investment firm had already defaulted on a forbearance agreement following earlier negotiations with one lender.

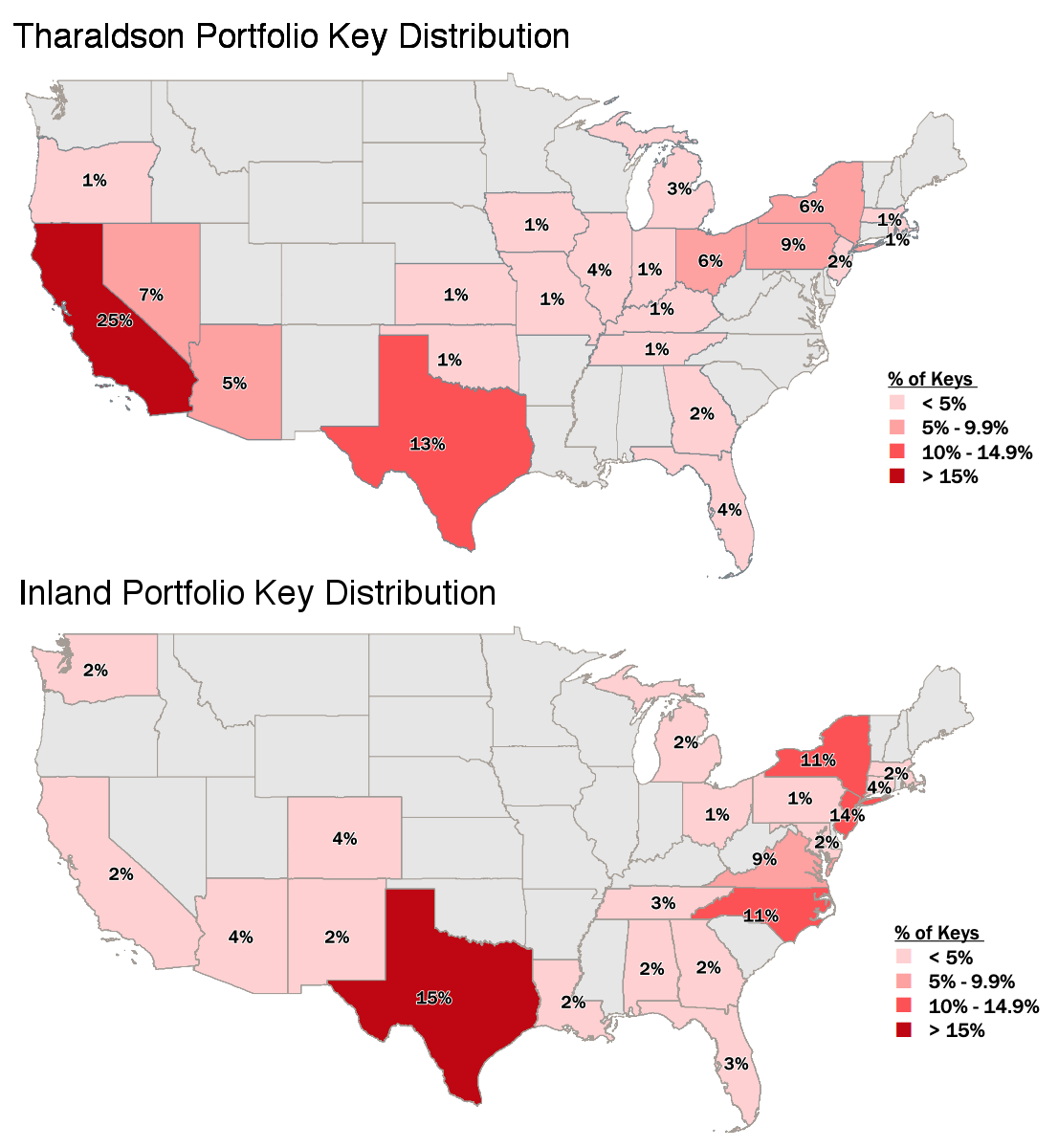

Now, Colony is in jeopardy of losing control of its two largest CMBS-financed hotel portfolios — the 89-property, 8,585-key Tharaldson portfolio and the 48-property, 6,402-key Inland portfolio. Both are on track to be transferred to the control of receivers as negotiations with lenders have failed to yield long-term solutions, court filings and servicer commentary show.

The fate of the Tharaldson (or THL) portfolio still depends on the outcome of a lawsuit. In mid-June, CMBS trustee Wells Fargo sued Colony Capital over defaults on the $768 million loan on the portfolio. Special servicer KeyBank National Association is acting on behalf of the trustee in the suit.

Due to the economic impact of coronavirus, the suit notes, the operating deficit at the properties is expected to total between $15 and 25 million over three months, a deficit which Colony is “unwilling or unable to fund.” These deficits also put numerous franchise agreements at risk, which would further impact the properties’ value, and will require the lender to make protective advances.

The Tharaldson and Inland portfolios are two of seven hotel portfolios Colony Capital currently owns, and which the company considers to be “legacy” assets as it focuses increasingly on digital properties like cell phone towers, optic fiber networks and data centers.

Both portfolios stretch across the country: Tharaldson hotels are in the Midwest, West Coast and parts of the Northeast and the South; while Inland properties are scattered around the Northeast, South, Southwest and West Coast. The larger hotels in the Tharaldson portfolio include the 206-key Courtyard Dunn Loring Fairfax in Virginia and the 203-key Courtyard Newark Elizabeth in New Jersey. The Inland portfolio includes the 229-key Sheraton San Jose Hotel and the 214-key Four Points by Sheraton Pleasanton, both in the Bay Area.

According to the suit, Colony first defaulted on a monthly loan payment in April, after which Wells provided a very short forbearance period of just one month. Colony then defaulted on the forbearance agreement as well by failing to make the subsequent May payment.

“Given the precarious position of the hotels and the millions of dollars [Wells Fargo] will be required to advance to maintain hotel operations,” Wells seeks to appoint a receiver to operate the hotels, KeyBank’s lawyers note. The special servicer nominated JLL’s receivership practice to take over the properties.

Once in receivership, the Tharaldson portfolio properties would then be foreclosed on or sold, according to the suit. That process could take several months, given the scores of hotels in nearly two dozen states.

Colony and KeyBank did not respond to requests for comment. Colony has until the end of this week to respond to KeyBank’s complaint.

As for the Inland portfolio, Colony and the lender on that $780 million CMBS loan have agreed on a receivership transition without having to go to court. The two sides have not been able to negotiate a loan modification. But the note said Colony “has agreed to an orderly transition of the properties to a receiver since agreeable terms for a loan modification could not be reached.”

Colony was previously a junior mezzanine lender on the Tharaldson portfolio, which at the time included 135 hotels in 28 states, and took control of the hotels in 2017 after prior owner Whitehall defaulted on the debt.

Colony owns a 55-percent stake in the Tharaldson portfolio alongside “certain managed investment vehicles.” According to loan documents, those vehicles include Colony Distressed Credit Fund II, Colony THL Co-Investment Partners, and a partnership of South Korean co-investors.

The Inland portfolio, meanwhile, is one of two portfolios that Colony owns 90-percent stakes in alongside minority partner Chatham Lodging Trust.

The U.S. hospitality industry continues to face serious uncertainty, as occupancy rates declined last week amid growing concerns about a second wave of coronavirus infections. CMBS loans are likely to be a major stress point because servicers have little leeway to make meaningful loan modifications, industry experts say.

Read more

Contact Kevin Sun at ks@therealdeal.com