The “tragic abyss” that coronavirus has created for Vornado Realty Trust’s finances now includes a massive writedown on some of the city’s most valuable retail real estate.

The real estate investment trust has recorded a nearly $306 million impairment loss on its Fifth Avenue and Times Square retail joint venture, according to preliminary estimates released Monday. That equates to a net loss of $1.50 per share, SEC filings show.

Meanwhile, Vornado has continued to see steady gains from its ultra-luxury condo tower at 220 Central Park South, which generated an after-tax net gain of $49 million in the second quarter. The abandonment of the ground lease at the Korein family’s 608 Fifth Avenue produced an additional $70 million gain, the SEC filing shows.

The recent wave of retail bankruptcies have also left their mark, as Vornado took a straight-line rent write-off of $36 million for the quarter, primarily for two bankrupt tenants — J.C. Penney’s lease at the Manhattan Mall at 100 West 33rd Street, and New York & Company’s lease at 330 West 34th Street.

Read more

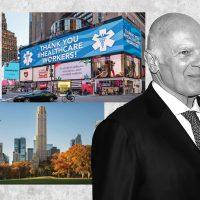

Vornado formed its Fifth Avenue and Times Square last April, by selling a 45 percent stake in the properties to a group including the Qatar Investment Authority, pension funds and Crown Acquisitions. Crown’s Haim Chera also joined Vornado as head of retail at that time. The portfolio includes five properties on Fifth Avenue grouped together between 51st and 55th streets, including the retail at the base of 666 Fifth Avenue.

The JV deal valued the retail properties at about $5.6 billion, and Vornado recorded a nearly $2.6 billion gain from the sale — part of which has now been reversed by the impairment loss, which was caused by a decrease in the fair market value of the portfolio.

Nonetheless, Vornado’s JV retail portfolio still benefits from its prime location. While rents in the Lower Fifth Avenue retail corridor have fallen 30 percent year-over-year, according to a new report by Cushman & Wakefield, rents on Upper Fifth Avenue and Times Square — where Vornado’s properties are located — have “only” fallen by 7 percent and 3 percent, respectively.

The JV deal has also reduced Vornado’s exposure to the retail market. “We made the early call on the secular decline of retail five or six years ago, and everybody laughed at us. And here we are,” CEO Steven Roth said in May on the firm’s first quarter earnings call. “I don’t think that the physical retail store is dead, but I do think it’s certainly injured.”

At the time, the landlord reported that it had collected just 53 percent of retail rents for the month of April, compared to 90 percent of office rents.

Vornado did not respond to a request for comment. The company’s second quarter earnings call is scheduled for August 4.

Amid the current uncertain economic environment, Vornado announced last month that it was considering the sale of a pair of office buildings, in Manhattan and San Francisco, which it co-owns with President Donald Trump.

Contact Kevin Sun and ks@therealdeal.com.