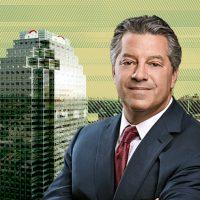

Though New York City reached Phase 4 of reopening this week, office workers have been slow to return. As the city’s largest commercial landlord, executives at SL Green are seeing this first-hand.

“Office space utilization is still quite low during these summer months,” CEO Marc Holliday said on a second-quarter earnings call Thursday. “Most of our tenants are telling us that they are planning for a 50-percent, plus or minus, return to the office after Labor Day,”

“While we still have a long way to go with this pandemic, the trend here is very positive, and has been that way for weeks now with various parts of life starting to return to normal,” he added.

On the rent collection front, SL Green reported a gross billing of 91 percent overall — 96 percent for office and 70 percent for retail.

“Tenants are definitely paying at a slower pace, but the vast majority are paying, and the pace of collections has actually improved every month from April through July,” CFO Matt DiLiberto said, noting that these figures do not reflect rent relief deals or the “very rare” use of security deposits.

“If we were to report on that basis as I see many others doing, the numbers would be substantially higher,” he said.

While months of pandemic-induced remote work have cast doubt on the future of the office market in New York City and elsewhere, SL Green executives expressed confidence in the long-term fundamentals of the city and its offices.

“The next few quarters will be difficult and there will be hurdles to clear,” Holliday said. “But we are built for these moments, we believe in New York, and we expect to be stronger and better positioned compared to our competitors when this crisis too shall pass.”

SL Green reported net income per share of $0.74 for the quarter, down from $1.94 a year before.

Read more

Cash cushion complete

The real estate investment trust’s main objective for the past quarter was its “Billion Dollar Plan” to build up a substantial liquidity buffer to help weather the uncertain economic environment.

That goal had been achieved by early June, with the help of big deals like the sale of a 49.5-percent stake in One Madison Avenue to Hines and the National Pension Service of Korea, and the $170 million sale of a retail condominium at 609 Fifth Avenue to the Reuben Brothers.

Another big source of cash was the sale of positions in SL Green’s debt and preferred equity (DPE) portfolio. In the second quarter, the company generated $488 million in cash proceeds from the sale of five such positions, and its DPE portfolio has been reduced to $1.25 billion.

“There is incredible value to the debt and preferred equity business in the SL Green platform, and we expect to do this business for many years to come, but as a component of the earnings power of this platform, not the driver of it,” DiLiberto said.

The company expects to make more sales in the second half of the year, and is reportedly marketing a $100 million mezzanine loan on the massive One Court Square office building in Long Island City.

“We’re still selling more than we’re originating, but when we feel that inflection point in the market, we’ll probably net originate again,” Holliday said.

Leasing landscape

While the second quarter was the slowest quarter of office leasing Manhattan had seen in a decade, SL Green did manage to get quite a few deals done — though most were renewals and none were particularly large.

The company inked a total of 35 leases for 280,000 square feet in the quarter, with an average lease term of 4.3 years and an average of 4.5 months of free rent. Many if not most of the renewal leases were closed without the involvement of a broker, director of leasing Steven Durels said, which helped reduce transaction costs.

And on the new lease front, Durels noted that he has yet to see any major shift in office rents because “by and large, tenants are looking for more movement on concessions as opposed to face rent.”

“Whenever there’s a major market disruption, tenants go on the defensive,” Durels elaborated. “They’re willing to pay the rent but they want the concessions to be beefed up and that comes out of the landlord’s pocket.”

Crisis & opportunity

The completion of the company’s liquidity buffer also allowed it to resume its long-running, $3 billion share buyback program. And over the next few years, the company is prepared to pursue other investment opportunities as they arise.

Every prior cycle has featured naysayers claiming that “New York’s done,” and “it’s never coming back,” Holliday said, noting that his firm’s upbeat view of the city’s long-term prospects have worked to its benefit in the past.

“I’d say that most of our money has been made within one to three years of coming out of downturns,” he said, “because we take advantage of apocalyptic thinking that I don’t think will apply to this situation.”

In particular, Holliday noted that every previous downturn has presented the firm with an opportunity to take control of an asset in its DPE portfolio. And for this cycle, that opportunity has already appeared.

SL Green holds a preferred equity stake in the ground underneath the Lipstick Building at 885 Third Avenue, where the building owner — Argentina’s Inversiones y Representaciones Sociedad Anónima — recently defaulted on ground rent payments.

The REIT is now “on track to basically have pref equity ownership rights again in the fee, unencumbered by the leasehold,” Holliday said. “We intend to lease and manage and operate that building going forward, and that’s a big opportunity for us.”

The firm is coming up with a redevelopment plan following the departure of a major law firm tenant next year, and believes that the iconic property can command the highest rents on Third Avenue.

“It’s not loan-to-own, by the way. That may be the outcome, but the intent was never to loan to own,” Holliday added. “In this particular case ownership has made the election to pass the baton to us.”

Contact Kevin Sun at ks@therealdeal.com