Clipper Realty reported a record second-quarter net profit, a rarity among real estate investment trusts this earnings season.

The Brooklyn-based REIT said it benefited from strong rent collections across its portfolio, and strong leasing at its recently opened apartment complex in Brooklyn Heights, and additional revenue from its newly renovated rental building on the Upper West Side.

During an earnings call on Monday, the residential and commercial landlord reported a net profit of $17.3 million from April through June, up 8.7 percent from the same period last year. Revenue for the quarter was $30.7 million, up 8 percent year over year.

Read more

Co-chairman and CEO David Bistricer called the results a “testament to the strength and durability of our business during the pandemic.”

CFO Michael Frenz attributed the revenue rise mainly to bringing the 159-unit Clover House in Brooklyn Heights online during the third quarter of 2019. The 82-unit, newly-renovated 10 West 65th Street on the Upper West Side also contributed revenue, Frenz said.

J.J. Bistricer, the company’s chief operating officer, said Clover House was now 97.5 percent leased. He said the “average $72 per-square-foot rent is a new record.”

The one down note was the Tribeca House, the two-building, 505-unit mixed-use complex, which Clipper bought for $410 million in 2018. The property was 91 percent leased at the end of the second quarter, after having been nearly fully leased before the pandemic.

“We believe the decrease is temporary, and that occupancy will return to its previous level as Tribeca has continued to offer a luxury level experience at a more attractive price point compared to the surrounding neighborhood,” J.J. Bistricer said.

The company said it was moving ahead with the plans to develop a nine-story, 175-unit apartment building at 1010 Pacific Street in Brooklyn. The building is eligible for the 421a tax abatement program, and will set aside 30 percent of units as affordable housing.

Clipper, which debuted on the New York Stock Exchange in early 2017, also said it has fared well with rent collection during the pandemic, but did not provide specific details.

J.J. Bistricer said rent collection for the second quarter across its portfolio was 94 percent of what the company collected in the first quarter. He added that Q1 rent collection was not affected by the pandemic, but did not provide an actual collection amount.

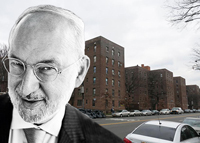

The REIT’s largest multifamily property by far is the 2,500-unit, mostly rent-stabilized Flatbush Gardens complex in Brooklyn. It was 97.2 percent leased at the end of June, the company said. The rent collection figure for that property was not provided either.

David Bistricer is part of a coalition of landlords funding a federal lawsuit challenging the constitutionality of New York’s rent stabilization law passed last year, which eliminated luxury decontrol among other changes.

Contact Akiko Matsuda at akiko.matsuda@therealdeal.com