The country’s biggest shopping mall is trying to stave off foreclosure after falling months behind on its $1.4 billion mortgage.

Triple Five Group, which owns the Mall of America, has entered into a cash-management agreement with a special servicer, CWCapital Asset Management, according to the Star Tribune.

Canada-based Triple Five began to fall behind on payments several months ago and the loan was transferred to special servicing in May. A representative reported that revenues had plunged 85 percent, according to the Tribune.

Triple Five is a family firm led by CEO Don Ghermezian and chairman Nader Ghermezian. It has been struggling for years to get the American Dream Mall in New Jersey’s Meadowlands going.

Read more

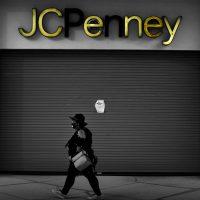

Malls across the country have been battered by the pandemic, which has forced many retailers to close and triggered a slew of lawsuits between tenants and landlords over unpaid rent.

A number of struggling retailers, including Tailored Brands, Brooks Brothers and J. Crew, have filed for bankruptcy. Last month, the anchor tenant of the luxury Hudson Yards mall in New York, Neiman Marcus, said it would never reopen the West Side location. The Texas-based department store filed for bankruptcy protection in May.

Differences in state pandemic rules mean some malls have been allowed to reopen, while others remain shut. Mall of America reopened in June and tenant rent collection reached 50 percent in July, up from 33 percent in April.

The mall owner’s cash-management agreement comes with greater reporting requirements and remittance of net cash on a monthly basis, according to Trepp. [Star Tribune] — Sylvia Varnham O’Regan