The early coronavirus outbreaks and exodus of New York City residents had some folks biting their nails over the future of American cities.

Would the pandemic cause urban areas like New York to regress into 1970s versions of themselves, characterized by population loss, crumbling infrastructure and plummeting property values?

Recent data on home sales and values show the answer is no. A report from Zillow found urban and suburban residential real estate markets have fared similarly since the coronavirus hit the United States.

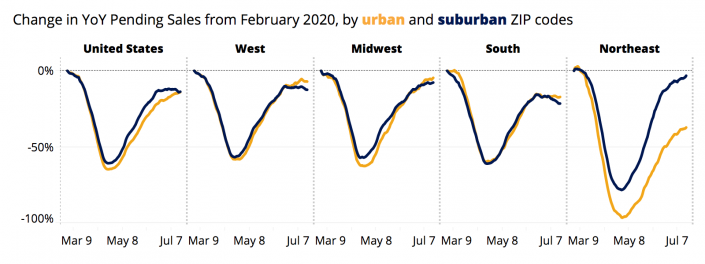

Pending home sales nosedived about equally in urban and suburban areas, according to the report. In all geographic regions they dipped by at least 50 percent at some point between March and July.

The Northeast was the exception, as urban pending sales did not match the suburbs’ pace. Still, the drop in urban sales likely has more to do with a supply drought than a drop in demand for urban homes. New urban listings in the Northeast tanked just after the pandemic hit, which presages fewer sales down the line.

In both urban and suburban places, homes are now selling faster and with fewer price cuts than before the pandemic. In the South, which is home to 41 percent of new pending sales, the time on market increased in urban areas but declined in the suburbs. In the Northeast, tight urban inventory led to days on market falling faster in urban places than in the suburbs. Across the board, price cuts in June are down compared to February.

Nationwide, annual growth in home values in urban and suburban ZIP codes is similar, at 4.3 and 4.1 percent, respectively, according to the report. Home values during the pandemic grew marginally faster in the suburbs: 0.6 percent faster annually in June than in February, versus 0.5 percent in urban areas.

This trend of suburban home values rising faster is typically more pronounced where it was already happening before the pandemic, the report found. Comparing February with June, urban home value growth slowed while suburban growth quickened in Boston and New York, both places where the deceleration of urban home value growth was already well underway. The opposite was true in Chicago, with suburban home values growing slower than urban prices after the pandemic hit.

The Zillow research team also searched for a divergence in property values between detached single-family homes, which dominate the suburbs, and condominiums, which are more popular in cities. They found no striking differences: Single-family home values are appreciating 4.4 percent annually and condo prices 3.1 percent.

Still, in some places, the value of detached single-family homes appreciated faster than that of condos. In New York and Boston, metro-wide home values for single-family homes grew faster than they did before the pandemic.

Price growth in cities has slowed down compared to price growth in the suburbs, but the Zillow researchers caution that this likely has to do with the kinds of homes being sold. Before the pandemic, sale prices were growing 6.4 percent annually in the suburbs and 9.3 percent annually in urban places. By June, sales price growth had fallen to 3.3 percent in the suburbs and 0 percent in the city.

The one metric that looks undeniably grim for cities and their landlords is rental pricing, which is clocking slower annual growth in urban places than in suburban places nationwide. Urban annual rent price growth has slowed down 0.6 percentage points more than suburban rent price growth, according to the report. In some cities the spread in rent growth between urban and suburban places is even wider: In New York, it’s 2.5 percent.