In what could soon be the biggest single-property acquisition of the Coronavirus era, a South Korean consortium has signed a preliminary agreement to buy a Seattle office tower for nearly $700 million.

The group, consisting of Hana Alternative Asset Management and other units of Hana Financial Group, has been selected as the preferred buyer for Skanska USA’s newly-constructed Qualtrics Tower, according to South Korean news outlet Maeil Business. Wednesday’s report cited investment banking sources. The Korea Economic Daily also reported on it.

The largest tenant at the 701,000-square-foot property is Utah-based experience management company Qualtrics, which leased 275,000 square feet at the building for its co-headquarters last fall. The company also acquired naming rights to the 38-story tower, which was originally known as 2+U.

Other long term tenants at the property include Indeed.com, Dropbox and co-working firm Spaces. Its central location in downtown Seattle and stable rent roll attracted the attention of several other bidders besides Hana, according to Maeil.

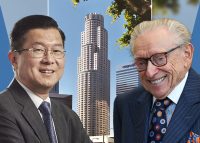

If the deal does close at the reported price, it would mark the largest single-property real estate transaction in the U.S. since the beginning of the pandemic, surpassing deals like Michael Shvo and partners’ acquisition of the Transamerica building in San Francisco (which took a 10-percent discount due to the pandemic) and Silverstein Properties $430 million buy of Downtown LA’s US Bank Tower.

The sale price is reported to be 800 billion Korean won, or about $688 million, and Hana Financial will now proceed with on-site due diligence. About 300 billion won — $260 million — will consist of equity interests to be syndicated to institutional investors in South Korea, while the remainder will be financed with debt from U.S. institutions.

Responding to the news of a pending sale, Skanska USA’s Murphy McCullough said in a statement there were no “material transactions to report.” McCullough did say that “while it is expected that we explore opportunities, we are only interested in those that are best suited for 2+U, our tenants, the city of Seattle, our company and are favorable for the long run.”

Read more

Institutional investors from South Korea have emerged as major players in global real estate investment in recent years, and the country was the third largest source of overseas investment in U.S. real estate between July 2019 and June 2020 according to Real Capital Analytics. The Federal Reserve’s recent interest rate cuts have removed some of the currency-related barriers to Korean investment in the U.S. that existed in prior years.

Hana Financial itself is no stranger to the Seattle market, having teamed up with Hotel Lotte for the $175 million acquisition of the hotel portion of the F5 Tower in downtown Seattle last December.