Dimitri Dixon has done appraisals for Cushman & Wakefield since 2007, but unlike most workers, she ended up in debt to her employer.

Under the firm’s pay structure, the appraiser receives a loan, known as a recoverable draw. When she finishes, the company deducts from the loan balance any fees she incurred. If the fees exceed the advance, the employee is paid the difference. But sometimes the fees are less than the draw and the employee ends up owing the firm.

Dixon was in debt to Cushman & Wakefield for all 11 years she worked there, according to a class-action lawsuit she filed against the company in California.

In 2017 — 10 years into her employment — the firm held a promissory note against her for $54,000, “equal to the total bi-monthly draw payments received throughout the year,” the case reads.

Although the amount was eventually reduced, when Dixon was fired in 2018, she still owed $15,632.

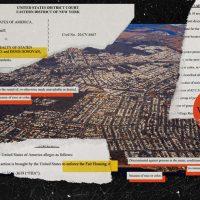

Dixon is not the only appraiser to take issue with Cushman & Wakefield over its pay practices. At least three separate class-action lawsuits filed against Cushman & Wakefield last year, in Colorado, California and Washington, D.C., make such complaints.

Read more

“I don’t know [what] is a driver of how they came to be filed at the same time,” said Deirdre Aaron, partner at Outten & Golden involved in the D.C. case. ”But I do certainly think that shows this was not just the instance with our client. There’s certainly other appraisers out there who are feeling the same issues.”

Cushman & Wakefield refused to comment, citing ongoing litigation.

The appraisers in the D.C. case do not work under the same recoverable draw structure that Dixon did. Their lawsuit alleges appraisers, because of how they were classified by Cushman & Wakefield, did not receive overtime pay despite working more than 40 hours a week and sometimes more than 60.

“Working overtime was a routine and necessary part of my job,” appraiser Katherine Pierno said in a declaration filed in the case. “I could not complete all of my required job duties in a 40-hour workweek, and my supervisor often encouraged me to work long hours and on weekends in order to meet deadlines.”

As non-salaried employees, the appraisers should have gotten compensation, their lawsuit says.

“Our main argument is that our client and other junior appraisers were not doing the type of sophisticated work that would render them exempt under the Fair Labor Standards Act,” Aaron said.

Cushman & Wakefield has employed more than 400 appraisers who were paid in a similar manner, according to the lawsuits.