Two of the largest minority-owned real estate investment firms in the country are teaming up to launch what they say is the first public real estate company dedicated to affordable housing.

California-based investor Avanath Capital Management and San Francisco’s MacFarlane Partners filed paperwork with the U.S. Securities and Exchange Commission to launch a new real estate investment trust targeting $1.6 billion in investments.

Read more

“We will be the first publicly traded REIT to pursue a strategy focused on affordable and workforce multifamily housing,” the two Black-owned companies wrote Friday in a registration form for the new entity, dubbed Aspire Real Estate Investors.

“These sectors historically have been fragmented in ownership and underserved by institutional capital, yet they comprise a majority of the U.S. multifamily market (by units) and offer strong long-term fundamentals to generate attractive returns for investors.”

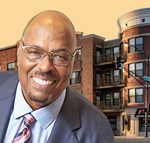

Avanath Capital, which as of 2018 reportedly had $1.2 billion in assets under management, was founded in 2007 by Daryl J. Carter. MacFarlane Partners was founded in 1987 by Victor MacFarlane.

A spokesperson for MacFarlane declined to comment, citing the quiet period after a registration statement is filed with the SEC. A representative for Avanath did not immediately respond to a request for comment.

The new REIT will target federal Opportunity Zones and other areas for investments in workforce housing and affordable housing, the latter of which it defines as developments where renters earn a maximum of 60 percent of the area’s median income.

The prospectus says Aspire Real Estate Investors has already lined up an initial portfolio of 9 investments in Illinois, Florida, Texas, North Carolina, California and Michigan that will cost $582.4 million once the acquisition and redevelopment costs are factored in. Aspire will buy the properties from Avanath.

In addition, the REIT said it has identified an acquisition pipeline totaling $1.1 billion in projects.