With prop-tech innovation on the rise, iBuying, the process of buying and selling homes through online platforms, has seen an increase in interest — and in funding. Major resi players like Zillow have gotten into the iBuying game, and frontrunner Opendoor is eyeing a multi-billion dollar IPO via a special-purpose acquisition company, just months after online homebuying plunged and iBuyers went on pause at the start of the pandemic.

Doubters think that iBuyers undercut prices, failing to consider the nuances of each individual home by relying solely on comps and data, and fear that they’ll cut residential brokers out of the homebuying equation entirely. Proponents say that iBuying doesn’t ruin the resi process — it transforms it. Right now, iBuying makes up just 0.5% of the US housing market — a small piece of the pie, but double the amount it had the year before.

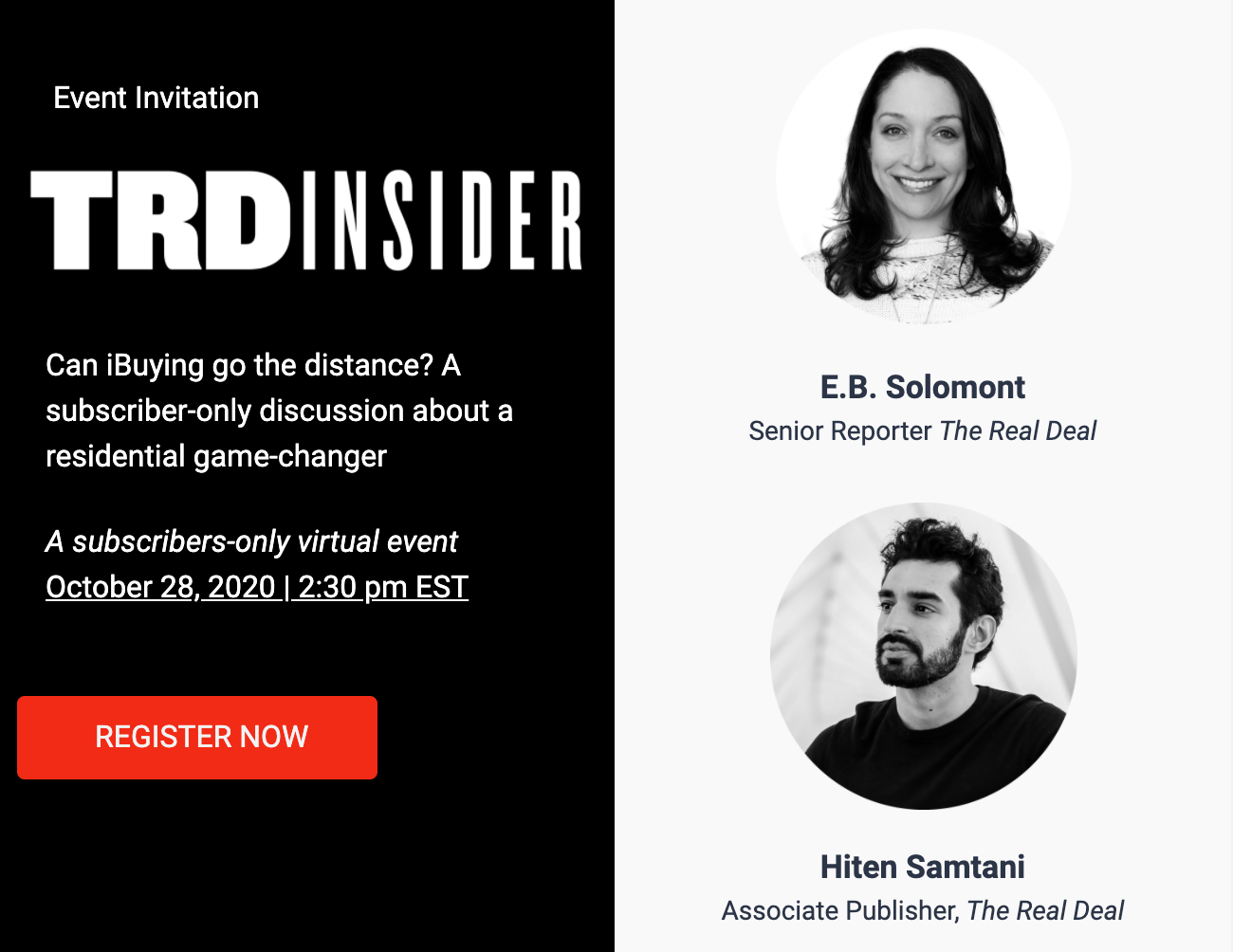

Join TRD‘s E.B. Solomont and Hiten Samtani on Wednesday, Oct. 28, 2020 at 2:30PM EST as they discuss the ins and outs of iBuying, and explore whether this small but disruptive faction is here to stay, followed by your Q&A.

On the agenda:

- Will iBuyers’ stock continue to rise, or will the fad fade?

- What would an increase in iBuying mean for the housing market?

- What happens to residential brokers in an iBuyer’s world?

- Can a data-driven process correctly define the value of a home?

- Is there a path to profitability for iBuyers?