The Empire State Building’s observation deck reopened to the public three months ago, but that hasn’t been enough to help its owner stem its losses this year.

Empire State Realty Trust reported a net loss of $12.3 million, down from $26.8 million in net income a year ago, the real estate investment trust reported during its quarterly earnings call Thursday. Its total revenue during the third quarter was $146.6 million, down by 24 percent year-over-year.

This is the second consecutive quarter in which the REIT reported a net loss; it lost $19.6 million in the second quarter.

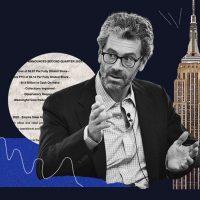

“ESRT continues to adjust on a daily basis to smooth tenant re-entry, collect rents, manage Observatory visits, assist survival of our local retail tenants, and ensure ESRT employee safety,” said Tony Malkin, the company’s CEO and president, during an earnings call Thursday.

Third-quarter rent revenue from ESRT’s 10.1 million-square-foot portfolio in New York City, Westchester County and Connecticut was $140 million, down 7 percent compared to a year ago, but up 1 percent from the second quarter. Rent collections hit 94 percent, up 9 percentage points.

Read more

Malkin said the company’s focus on indoor environmental quality enabled its tenants to return to their offices safely. Occupancy at ESRT’s buildings has grown to 45 percent in Westchester and 55 percent in Connecticut, while occupancy in its New York City buildings stayed below 15 percent, he said.

During the third quarter, Li & Fung signed a new lease for about 103,000 square feet for an 8.3-year term at the Empire State Building, according to the company. In October, Centric Brands inked a new 212,000-square-foot lease for a 7.9-year term at the iconic skyscraper. Centric Brands had been subletting the space from Global Brands Group.

Still, the REIT has implemented a series of cost-cutting measures to weather the ongoing crisis. It furloughed 156 employees at two locations — 60 East 42nd Street and the Empire State Building — and laid off six, according to a WARN notice from the state’s Department of Labor.

In addition, the company has suspended its third and fourth quarter dividend to shareholders.

“The management team and the board believes that payment of a dividend is currently not the highest and best use of our balance sheet, giving continued uncertainty in the macro environment, benefits of maximizing our operating runway and a significant discounted valuation of our stock,” said CFO Christina Chiu.

The firm also faces a unique challenge in the Observation Deck, whose attendance during the third quarter was only 6 percent compared to a year ago.

The revenue from the observatory was $4.4 million, down 88 percent compared to the same period last year when it took in $37.6 million.

“We are confident that travel will return, and we are confident about the future of New York City,” Malkin said. “We also believe that we will not be out of the disruptions from Covid 19 until we see free travel in and out of New York City from states and countries.”