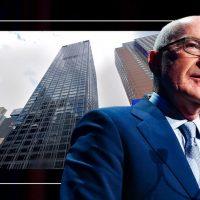

Paramount Group didn’t see a major improvement in its earnings in the third quarter, but there was one major change from the office landlord’s second-quarter earnings call.

“We are back in the office,” said CEO Albert Behler during a Thursday call for analysts, although he added that most of the firm’s tenants are taking a slower approach. Behler noted that the “vast majority” of Paramount’s tenants expect to return to the office in early 2021, and that the company is extending lease expiration deadlines as a way to reintegrate current tenants.

With investments mainly in New York and San Francisco office markets, the real estate investment trust recorded $7 million in losses for the third quarter, a slight increase from the $6.3 million it lost last quarter.

Read more

Behler said Paramount’s “trophy assets” had “little exposure to retail,” and noted that luxury jeweler Harry Winston recently signed a 16-year lease for 18,000 square feet at 712 Fifth Avenue. The deal required knocking down a wall in an adjacent building, which Paramount manages, into the building it owns, expanding the jeweler’s footprint to a total 37,000 square feet.

Paramount’s share price fell from a high of $14.67 in February to $5.72 at Thursday’s closing bell. The company reported buying back 3 million of its own shares from investors in the third quarter, at $6.77 per share, worth $20 million total.

Behler said the company remains focused on leasing its available office space, including 500,000 square feet at 1301 Sixth Avenue, which Barclays will vacate at the end of the year, and 130,000 square feet at 31 West 52nd Street, which TD Bank is leaving.

The firm was aiming to lease much of that space before 2021, but the pandemic put a pin in that; Paramount now expects any lease at the larger location to be signed next year. Behler said during the earnings call he expects San Francisco revenue to lag due to extended lockdowns on the west coast.

The company still expects the sale of its last Washington D.C. building, at 1899 Penn Avenue, to close at $115 million in the fourth quarter. Otherwise, the acquisitions market remains sparse. “Opportunistic buyers are looking for bargains but sellers aren’t reducing their asking prices,” preferring to refinance at historically low interest rates, said Behler.

“How long this plays out is unknown,” he added.