The 10 largest outer-borough loans in December totaled $1.17 billion, a sharp drop-off — about 40 percent — from the November total of nearly $2 billion.

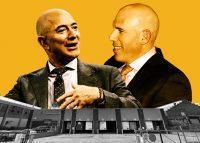

But one loan stood out from rest, and it’s no surprise Amazon was involved. That $272.9 million loan from JPMorgan Chase partially finances a project to develop a mega warehouse in Queens for the e-commerce behemoth.

Five of the loans last month were for properties in Queens and four were for Brooklyn parcels, with one in the Bronx.

Overall, the industrial real estate sector was one of the few bright spots in New York’s pandemic-ravaged market in 2020. Here are the largest outer-borough loans for the month of December:

1) Amazon effect | Queens | $272.9 million

RXR Realty and California-based LBA Realty secured the loan from JPMorgan Chase for their five-story warehouse development project at 55-15 Grand Avenue in Maspeth. RXR general counsel Jason Barnett signed the loan document. The loan is part of the $316 million financing package to construct the 770,000-square-foot facility reportedly leased to Amazon.

2) Sun shines | Queens | $59 million

Sun Equity Partners refinanced its retail development at 40-31 82nd Street on the border of Jackson Heights and Elmhurst, with the loan provided by New York Community Bank. The privately-held Sun Equity, in partnership with Heskel Group, has been working on the project for several years. The developers once wanted to construct a 160,000-square-foot building, but after meeting community opposition, they downsized the facility into about 38,000 square feet, according to a zoning diagram filed with the Building Department.

3) Trust Zara | Queens | $54 million

Zara Realty Holdings refinanced its loans for the two multifamily properties at 166-33 89th Avenue and at 87-50 167th Avenue in Jamaica, with the loan from the Northern Trust.

4) Rose in bloom | Bronx | $53.4 million

Jonathan Rose Companies secured a $53.4 million loan from Merchants Capital Corp to finance its $64 million purchase of a 190-unit affordable housing building at 350 St. Ann’s Avenue in Mott Haven. The seller was Omni New York, which bought the complex for $15.5 million in 2004.

5) Towers rising | Queens | $49 million

Flushing Point Holding, led by Maohua Dong and Yong Qin, secured a $49 million loan from Delta FP Holdings for the property at 131-02 40th Road in Flushing. The company wants to eventually construct a three-tower mixed-use complex, to be known as Flushing Point Plaza. The development will consist of two 20-story towers and one 19-story tower, with 469 hotel rooms and 330 residential units, along with commercial space, according to documents filed with the Department of Building.

6) Prime time | Queens | $43.5 million

A joint venture of Circle F Capital and ZD Jasper Realty took out a $43.5 million loan from Maxim Credit Group for the property at 22-43 Jackson Avenue in Long Island City. The venture is constructing a 11-story, 71-unit residential building called the Prime, designed by SRA Architecture + Engineering. A Trader Joe’s is set to open sometime this year in the property’s commercial space.

7) Daten develops | Brooklyn | $40 million

Daten Group has taken out a $40 million loan from Mack Real Estate for its condominium development at 575 Fourth Avenue in Park Slope. Condo units at the 70-unit complex are priced between $699,000 and $1.5 million, according to the 575 Fourth website.

8) Secured from Signature | Brooklyn | $34 million

Yehoshua Leib Fruchthandler and Jeffrey Zwick, under the entity 615 East 104 Holdings, secured a $34 million loan from Signature Bank. It will finance their $51.3 million purchase of the five-story building at 633 East 104th Street. The seller was E&M Management, a major apartment landlord in Northern Manhattan, Brooklyn and Queens. E&M bought the building for $12.5 million from Canarsie Hotel.

9) Dealing on Delavan | Brooklyn | $31.5 million

Acuity Capital Partners took out a $31.5 million loan from Northwind Group for three parcels at 21 and 35 Delavan streets in Red Hook, and 2269 First Avenue in Manhattan. At the same time, the ownership of 21 and 35 Delavan streets was transferred from Eugene Mendlowitz to Acuity Capital Partners, according to the property’s deed, which did not include the sale price. The Manhattan parcel has been owned by Acuity Capital since 2014, according to property records.

10) Ballgreen baller | Brooklyn | $31.3 million

Montreal-based Rester Management borrowed $31.3 million from Canadian Imperial Bank for its purchase of a 62-unit multifamily property at 186 Lenox Road in Flatbush. Rester’s Nitanel Deitcher signed the loan document. The property, listed as the Ballgreen on Streeteasy, was recently developed as a luxury rental apartment building.

Read more