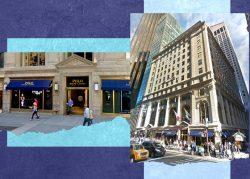

Who deserves to be on Fifth Avenue? That question is at the heart of a legal battle between Ralph Lauren and the landlord of its store on the shopping corridor.

In 2017, Ralph Lauren shuttered the 28,300-square-foot store at 711 Fifth Avenue, but continued to pay roughly $27 million annually for the unoccupied space. To lessen its losses, the luxury retailer made an agreement with Spanish fast-fashion chain Mango to sublease the storefront for around just $5 million annually.

But that agreement may never come to fruition. New York-based real estate investment firm Shvo Group, Bilgili Group, Deutsche Finance and the German pension fund BVK rejected the sublease on the grounds that Mango doesn’t meet the caliber of luxury tenant they envision for the property, according to Business Insider.

Read more

If the sublease were accepted, it could set a dangerous precedent for low rents on the luxury street.

“Landlords are loath to contribute to massively discounted market lease comparables,” Michael Glanzberg, a principal at the retail leasing and consulting firm Sinvin Real Estate, told the publication. “With broad vaccination around the corner, no owner wants to benchmark Covid rents.”

Rents on Manhattan’s retail corridors have hit historic lows amid the pandemic. On Fifth Avenue, the average asking rent hit $271 per square foot, a 22 percent year-over-year decline.

Shvo’s firm, along with partners including Bilgili Group and Deutsche Finance, purchased the Fifth Avenue building, also known as the Coca-Cola Building, in 2019 for $937 million.

[BI] — Sasha Jones