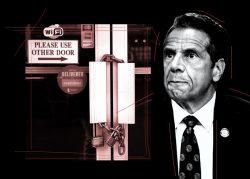

The New York state legislature is moving ahead with its own commercial eviction and foreclosure bill, despite Gov. Andrew Cuomo including a similar measure in the state’s budget.

The bill, sponsored by Assembly member Harry Bronson of Rochester and Sen. Anna Kaplan of Long Island, would ban evictions of businesses with fewer than 50 employees until May 1. It differs from the current blanket eviction ban, which draws no distinction between small and large businesses.

The legislature’s proposed ban would also create a standardized hardship declaration form that tenants would use to determine eligibility. The current ban, stemming from an executive order which has been renewed continually since last March, does not require a hardship declaration.

Read more

Commercial tenants would not be required to disclose the amount of relief they have already received, in contrast to Cuomo’s proposal. The legislature’s bill would also stop foreclosures and tax lien sales for businesses with 50 or fewer employees, or 10 or fewer rental properties.

Of the measures on the table to combat mounting unpaid rent, the legislature’s is the least-favored by the real estate industry.

Federal and state governments have largely sought to postpone the most drastic outcomes of unpaid debts, such as evictions, tax lien sales and foreclosures, rather than provide vouchers or cancel rent arrears. The rollout of the state’s $100 million rent relief program in 2020 was widely criticized as insufficient, even by some lawmakers who voted in favor of it, and the state agency tasked with administering the program turned away more than half of those who applied for the funds.

“Once again lawmakers are acknowledging the importance of small businesses while completely ignoring the costs necessary to provide space for commercial tenants,” said Jay Martin, president of the Community Housing Improvement Project, which represents landlords.

Martin argues that the government’s response, which has focused on stopping evictions and foreclosures, rather than paying rent debt, is unsustainable.

“If you want to protect small businesses, help them pay their rent so property owners can pay their bills when this crisis is over,” said Martin.

In January, CHIP estimated that in its members’ rent-regulated apartments, tenants now owe around $1 billion in rent arrears. Some have estimated the statewide unpaid rent total, including for market-rate housing, to be $3 billion.

The legislation has already passed in the Senate, and the Assembly has said publicly that it will pass it. Passage of the budget, meanwhile, is due April 1, and public hearings on its components begin this week. The budget agreement will be hashed out behind the scenes by Cuomo, Senate Majority Leader Andrea Stewart-Cousins and Assembly Speaker Carl Heastie, during which some of the governor’s proposals will be removed.