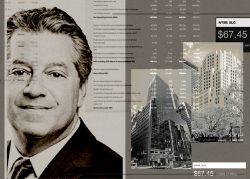

SL Green Realty is unloading its stake in Midtown’s Tower 46.

The real estate investment trust is in contract to sell its 25 percent interest in the commercial condominium units at 55 West 46th Street to a Brookfield Asset Management real estate fund for a gross valuation of $275 million, or $793 per square foot, the REIT announced Tuesday.

The transaction is expected to close this quarter.

In 2014 SL Green acquired the office condo units and retail space totaling about 347,000 square feet in Tower 46, also known as International Gem Tower, for $295 million, or about $850 per square foot. The acquisition came as the building’s developer, Extell, struggled to attract tenants to those offices.

Read more

Later that year SL Green formed a joint venture with Prudential Real Estate Investors. Prudential became the owner of 75 percent stake, while SL Green kept the remaining 25 percent.

In its press release Tuesday, SL Green said the deal with Brookfield would generate net cash proceeds of about $20 million. But it was unclear how the figure was calculated. An SL Green spokesperson declined to comment.

In the deal, SL Green’s 25 percent stake is valued $5 million — or about 7 percent — less than it was valued for in 2014.

Ben Brown, managing partner with Brookfield Property Group, said the transaction “represents an opportunity to acquire a prime asset at a highly attractive basis and drive return through Brookfield’s operating platform.”

Paul Gillen, Anthony Ledesma, Kyle van Buitenen and Daniel Parker of Hodges Ward Elliott represented SL Green in the sale.

The office condominium market has also been hit by the pandemic and the shift to work-from-home it triggered.

According to Rudder Property Group, which specializes in office condos in the city, a comparison of sales before and during the pandemic in the same Manhattan buildings showed a 32 percent drop in price per square foot, from $909 to $616.