Lending in the outer boroughs remained sluggish in the first month of 2021, with the 10 largest loans issued outside of Manhattan totaling $1.38 billion. That’s slightly better than December, when the total was $1.17 billion, but significantly less than November when the total was nearly $2 billion.

The largest loan, which was issued in Brooklyn, was the only nine-figure deal for the month. Out of the 10 largest loans, six involved properties in Brooklyn. Queens and Bronx shared the rest.

1) Redsky at night | Brooklyn | $122.6 million

L3 Capital secured a $122.6 million loan from JPMorgan Chase for its acquisition of more than a dozen Williamsburg parcels, including 92, 102, 108, 124 and 134 North 6th Street; 188 Bedford Avenue; and others that were formerly owned by Redsky Capital. The developer handed the keys to those properties back to its mezzanine lender, BlackRock, in a deed-in-lieu of foreclosure action. BlackRock then did a joint venture with L3.

2) Charter construction | Bronx | $71.9 million

Highbridge Facilities secured a $71.9 million loan from the Bank of New York Mellon and Build NYC Resource Corporation for its acquisition of 1400 Cromwell Avenue in Mount Eden, and construction of facilities to be leased to Family Life Academy Charter Schools Corporation.

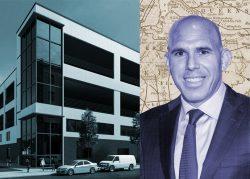

3) Gal Sela, Sela | Brooklyn & Queens | $63.3 million

Gal Sela’s Sela Group secured a $63.3 million loan from Madison Realty Capital backed by 256 Flushing Avenue and 29 Ryerson Street in Clinton Hill, and 39-35 27th Street in Long Island City. Sela’s firm purchased the properties from Madison in 2019.

4) Mixed-use on Maple | Queens | $57 million

NuVerse Advisors secured a construction loan for 136-18 Maple Avenue in Flushing. In December, the Department of Buildings issued a permit to build a 20-story, 113-unit building on the site. In addition to the apartments, the proposed building will have 40,500 square feet of commercial space and 50,738 square feet of community facilities.

5) Sheltered in Park Slope | Brooklyn | $52.4 million

Slate Property Group secured this loan from JLL Real Estate Capital for 535 Fourth Avenue in Park Slope. Slate signed a 99-year ground lease agreement with the property owner in 2014, and constructed a multifamily building on the site. But the developer later announced that the property would become a homeless shelter, leading to contention among neighborhood residents. The facility opened last year, according to Bklyner.

6) Diocese to medical | Queens | $42 million

Emanuel Westfried, operating under Astoria Crescent Owner, secured a loan for 30-14 Crescent Street in Astoria. The site, which has been a home for the Church of the Redeemer, was sold to the developer by the Archdiocese of Long Island for $10.8 million in December 2020. It will be developed into a seven-story medical building, according to Real Estate Weekly.

7) Charter construction, part 2 | The Bronx | $40.8 million

This loan is another piece of financing secured by Highbridge Facilities from the Bank of New York Mellon and Build NYC Resource Corporation to build school facilities for Family Life Academy Charter Schools Corporation. The properties behind this loan are Nos. 316, 325 and 335 East 165th Street in Concourse.

8) Berkshire backing Brooklyn | Brooklyn | $34.4 million

Robert Gershon with Gershon Company snagged a $34.3 million loan from Berkshire Residential Investments for the properties at 55 and 67 Hope Street in Williamsburg, as well as an adjacent property. The former houses a 117-unit rental apartment complex, while the latter has a parking structure.

9) Managing waste | Brooklyn & The Bronx | $33.1 million

Interstate Waste Services secured a $33.1 million loan for the properties at 620 Atkins Avenue in East New York, and 1 Plaza Place and 920 East 132nd Street in Port Morris. The loan was issued by Virtus Real Estate Capital in Austin, Texas.

10) Carlyle cool | Brooklyn | $32.5 million

Carlyle Group secured a $32.5 million loan from Invesco CMI Investments backed by 11 properties in Brooklyn, including 177 Jefferson Street, 194 Cooper Street, 236 Seventh Avenue, 24 Cornelia Street, 264 Kosciuszko Street, 27 Bleecker Street, 391 Fourth Street, 441 First Street, 493 Hart Street, 610 Bainbridge Street and 69 Schaefer Street.

Read more