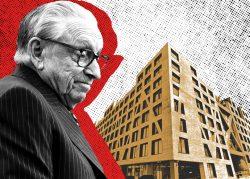

From scrapped deals and foreclosures to loan sharks and now, alleged deed fraud, legal headaches are continuing to pile up for Yoel Goldman’s All Year Management.

The developer filed its latest lawsuit last Friday, accusing partner Zoltan Berkowitz of seizing control of 14 Brooklyn properties despite having only a 10 percent interest in the portfolio.

“Berkowitz’s deed transfers are more than an ordinary coup. Berkowitz’s theft of millions of dollars of properties may have broad ranging repercussions that put the properties at significant risk of loss,” according to the complaint, filed in Kings County Supreme Court.

The transfers may furthermore “trigger millions of dollars of loans to go into default and may cause significant claims by holders of publicly traded bonds,” the filing continues. The lawsuit seeks the reversal of the property transfers, as well as an undetermined amount of damages.

All Year disclosed the lawsuit in a filing to the Tel Aviv Stock Exchange. The company did not respond to a request for comment. Berkowitz — who also goes by “Abraham,” “Anthony Zoltan,” or “Abe Z.” — could not be reached.

Read more

The 14 properties are located near the border of Prospect Heights and Crown Heights, on Bergen Street, Classon Avenue, Franklin Avenue, Pacific Street and St. Marks Avenue.

According to the lawsuit, All Year and Berkowitz acquired the properties in 2014. While the partners originally each had a 50 percent stake, All Year says Berkowitz handed over a 40 percent membership interest in exchange for $6 million in 2016, leaving him with a 10 percent stake in the portfolio.

But this February, deeds were recorded in city records transferring the properties to Ohr Olam Realty, with Berkowitz signing the documents on behalf of both buyer and seller. The sale price listed on each deed was $0.

“In addition to defendant Berkowitz being unauthorized to execute the deeds for the Prospect Properties, the purported conveyances of the Prospect Properties to Ohr Olam Realty LLC were made without consideration,” the lawsuit says.

Since having its bonds delisted from the Tel Aviv Stock Exchange at the end of 2020, All Year has been facing mounting financial and legal challenges.

Last week, the Israeli Securities Authority officially opened an investigation into All Year, and the company disclosed that it had received a request from investigators to provide information and documents. The company has also appointed a new chief restructuring officer, Asaf Ravid of CGI Strategies, after previous CRO Joel Biran stepped down.