Even though HFZ Capital Group has handed over the keys to four Manhattan condo projects, its lender is once again trying to take the embattled developer to court.

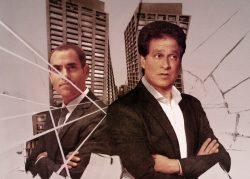

Last week, the lending arm Los Angeles-based CIM Group filed a lawsuit in U.S. District Court in the Southern District of New York, alleging that HFZ and its founder Ziel Feldman owe the firm over $48 million.

In January, CIM Group foreclosed on four Manhattan condo conversion projects — 88 and 90 Lexington Avenue; The Astor at 235 West 75th Street; and Fifty Third and Eighth at 301 West 53rd Street — and took control of the properties. But in its lawsuit, the company alleges that HFZ and Feldman are still obligated to pay for guarantees made on junior mezzanine loans tied to the four properties. CIM Group initially provided those loans in 2018.

Read more

In the lawsuit, CIM alleges that HFZ and Feldman owe a portion of the outstanding principal and interest on the junior mezzanine loans. In addition, the lender claims it’s owed money from the debt service on the senior mezzanine and mortgage loans, along with money owed for shortfalls in its reserve accounts.

CIM said that HFZ first defaulted on these loans in November 2019, and the lender provided notice of default to the borrower the following July. CIM attempted to sell the interests in the projects through a UCC foreclosure sale last November, but that faltered when HFZ sued to stop the sale. A judge sided with the developer, deeming the sale “commercially unreasonable.”

But in early January, CIM held another sale; its credit group bid on the properties using its existing debt and took control of the assets.

Marketing materials for the foreclosure sale showed that CIM’s junior mezzanine loans held a balance of $90.5 million. The properties’ total debt, including senior loans and senior mezzanine loans, amounted to $249 million.

The attempted conversion of the four pre-war rental buildings into condos was one of HFZ’s most ambitious undertakings. The development firm, led by Feldman, initially paid Westbrook Partners $610 million for the four properties in 2013, teaming up with Fortress Investment Group on the buy. The portfolio consisted of 743 rental units, and the partners subsequently began the process of converting the buildings into residential condos.

HFZ did not immediately return a request for comment. CIM’s attorney also did not return a request for comment.