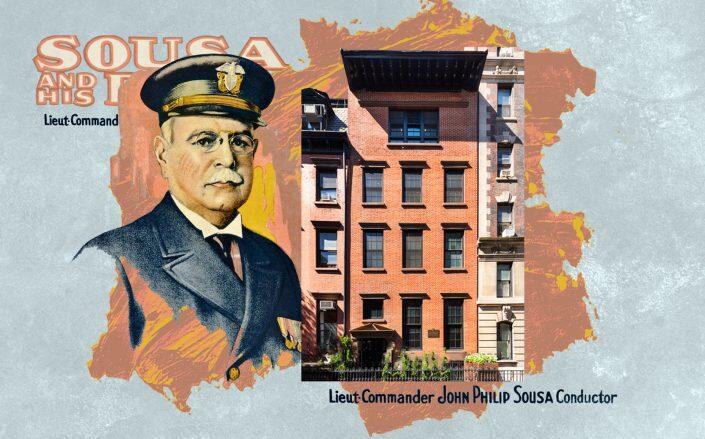

John Philip Sousa and the Sousa House at 80 Washington Place (Getty, Leslie J. Garfield)

Another foreclosure lawsuit has been filed against the owner of a West Village townhouse once owned by American composer and conductor John Philip Sousa.

On Wednesday, Emigrant Bank filed a foreclosure notice against 80 West Washington Place Real Estate Holdings, the limited liability company that owns the property at 80 West Washington Place.

The complaint, filed in New York State Supreme Court, claims that the owner owes the bank a mortgage principal of $13 million, along with interests and late charges accumulated since April 2020.

Earlier in March, the Galinn Fund, which provided a $3 million second mortgage to the townhouse owner, filed a foreclosure notice against the owner for alleged nonpayment. The Galinn Fund was also named as a defendant in Emigrant Bank’s complaint, with the plaintiff alleging that the property’s owners got the second mortgage from Galinn in violation of the initial mortgage agreement.

“The action against Galinn is procedural in nature being that Galinn holds a subordinate lien and will be dealt with accordingly,” said David Linn, co-managing partner of the Galinn Fund.

The 8,700-square-foot townhouse, built in 1839, has been on and off the market for nearly a decade. It’s currently listed with Leslie J. Garfield for $25 million, or about 21 percent less than the original 2012 asking price of $31.5 million.

James Burchetta, a lawyer representing the owner, said that the property has been generating interest from prospective buyers as the city opens up.

“It is unfortunate that lenders are not working with property owners, who have lost all rental income and have been impacted by this pandemic,” said Burchetta, adding that he believes the Emigrant’s action can’t move forward because of the state’s moratorium on commercial evictions and foreclosures.

The lender, however, believes the property is not covered by the emergency protection because it is not a commercial property, according to the complaint. In the complaint, lawyers for Emigrant also note that the state’s Emergency Eviction and Foreclosure Prevention Act of 2020 — which bars residential foreclosures and evictions — is not applicable because “the owner of the Premises is not a natural person, as required by the statute.”