Nearly a year after RFR Holding and Vanke US defaulted on the construction loan for their Midtown condo tower, the lender has run out of patience.

In a lawsuit filed Tuesday in Manhattan, the Industrial and Commercial Bank of China seeks to put the 63-story project’s unsold units into receivership and, if necessary, foreclose.

“Because the borrower is not selling condominium units and has ceased paying its real estate taxes, a receiver is necessary to begin selling and/or leasing condominium units,” ICBC’s lawyers argue in court filings.

The Chinese bank provided a $360 million financing package for the property, 100 East 53rd Street, in 2015. With 27 of the 94 residential condo units sold, it calculated the outstanding principal at $248 million and unpaid interest at $22 million.

Representatives for Aby Rosen’s RFR did not immediately respond to a request for comment.

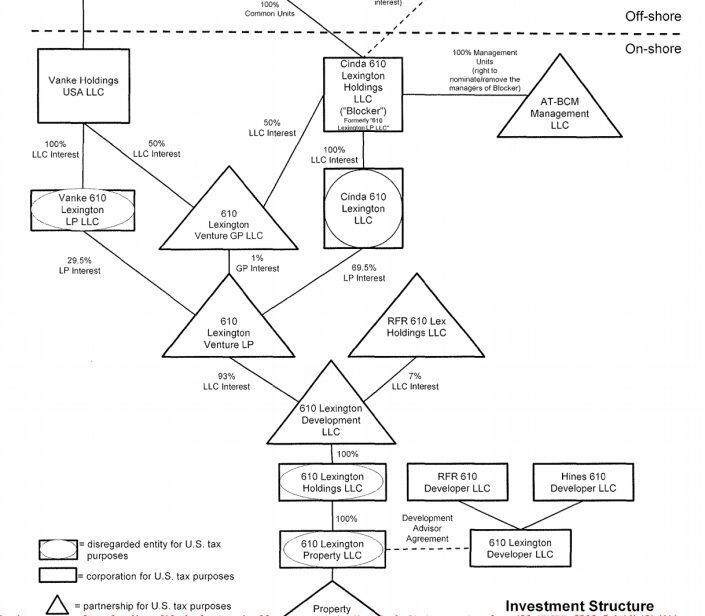

The financing went into default at maturity last May, leading to a public falling-out between RFR and Vanke in the fall. Rosen’s firm characterized Vanke’s acquisition of an interest in the loan as an improper “power grab,” while the Chinese developer accused RFR of sabotaging the project to get an “exorbitant buyout” for its 7 percent stake.

“Vanke is disappointed that it’s come to this, as it encouraged a workout and took proactive steps to prevent a foreclosure,” said a source familiar with the situation.

RFR last week was also sued by Solil Management over the ground lease at the Gramercy Park Hotel, which has been closed to paying guests and has fallen behind on ground lease payments.

Portion of organizational chart for the condo project, according to 2015 loan documents. Source: New York State Unified Court System