When John Mandyck met with Brazil’s largest pension fund a few years ago, he wanted to understand the thinking behind its radical declaration that it would only invest in certified green buildings.

“I was completely blown away because I was thinking they were going to say, ‘We have social pressures, we have ESG goals,’” recalled Mandyck, now the CEO of Urban Green Council, a New York-based nonprofit that advocates for improving buildings’ energy efficiency. “It had nothing to do with that. They were trying to future-proof their portfolio.”

The pension fund, Previ, was convinced that properties would not hold their value over the next decade unless they were green. Similar dynamics, Mandyck argues, are beginning to play out in New York City, the world’s most valuable real estate market.

The Real Deal caught up with him to discuss New York’s milestone climate policy, climate tech’s potential to create healthier and more equitable neighborhoods and Urban Green’s vision for a market to trade carbon credits.

Real estate’s culpability in the climate crisis hasn’t been a major focus. Why is that?

I would argue that’s no longer the case in New York City. We have a landmark law [Local Law 97] that will deliver the largest carbon reduction of any city in the world. You’re pointing to a bigger issue though, in how other cities and jurisdictions are looking at climate change.

I’ve seen far too often the classic pie chart of a jurisdiction’s carbon emissions. It’ll say: transportation, residential, commercial, industrial, waste. And [politicians] will say, “Oh, transportation is our largest source, so that’s where we have to put our priorities.” I’ll say, “no, buildings are your largest source — what do you think residential, commercial and industrial are? They’re buildings.” Once you do that, there’s an aha moment. This has happened at the highest levels of government that I’ve been working with over my career. Once you reframe the data, it becomes obvious where you need to focus attention.

In New York, where large-scale real estate ownership is so dynastic, is there more openness to the idea of transforming buildings?

The family-owned real estate enterprises think generationally. That’s their business model. And they are within sight of the generation where New York City will not function because of climate change. New York Harbor is up one foot over the last century. On top of that, New York has $3 trillion of insured coastal properties. That is twice the GDP of Canada. You can understand that this is a risk that needs to be managed.

One of the big opponents of some aspects of Local Law 97 was, and remains, the Real Estate Board of New York, which represents these owners.

We worked together with REBNY in the lead-up to the law. We met 80 times over eight months with 70 people from 42 organizations (Urban Green’s board includes top executives from Rudin Management, Brookfield, SL Green Realty and 32BJ SEIU). What we together recommended was an energy-efficiency law to be the backbone of Local Law 97. The city and the City Council decided it should be a carbon law. That was a major detour from what was expected. It gets you to the same place, but it leads to many other issues.

“Density should be your friend for sustainability. Under Local Law 97, it’s not.”

In this commercial building I’m in right now, when I turn that light on, the building is using energy, but it’s not directly emitting carbon. That carbon is being emitted at the power plant supplying the electricity, which could be five miles away, it could be 100 miles away. And every power plant burns at a different rate of efficiency. Some use different fuels. And so you have to understand exactly what’s happening at the power plant to understand the carbon emissions that are being driven. When it comes to electricity, building owners don’t exactly control carbon. They have no ownership over that power plant.

So what we’ve been working hard at is … how do we make it work? Because the last thing we need is some trophy law that we can all feel good about, but if it doesn’t work, then we don’t get the carbon reduction.

You make a great point about trophy laws. I was thinking about something related, which is the LEED standard. Every major building has some LEED designation. But that’s not going to move the needle. Is there an element of tokenism with some of these standards?

Right there is a good example of the difference between energy efficiency and a carbon cap. We have many LEED-platinum buildings in New York City that will never, ever comply with the law. They use energy super-efficiently, but if they have 15,000 people working in the building, you can’t get around the fact that the building as a whole just uses a lot of energy. So there is a disincentive for density that we need to find a way to fix. Density should be your friend for sustainability. Under Local Law 97, it’s not. It’s easy to understand and it’s easy to calculate, but it’s a pretty blunt instrument that’s blind to what’s going on inside the building.

Read more from The REInterview – In depth conversations with industry leaders and newsmakers

How do you start getting to that problem?

When the law was first proposed, there were caps based on three building categories. We got that expanded to 10. I think there should be 80, which is what Energy Star is. Offices have one cap, that’s it, it doesn’t matter what goes on in the office. So if you have a building that has high density, that has data centers and trading floors, it is held to the same carbon standard as the building next door, which could be law offices and insurance headquarters. I love them too, but they’re typically bigger office spaces, conference rooms, not operating 24-7. There is societal value for what’s happening in the building that has data centers, it’s keeping the internet alive, it’s keeping banking going. So we have to find a way for those buildings to comply, when right now they can’t just because they have these energy-intensive operations going on.

In your report, you focus on the technologies available now. How much of the problem is adaptation and implementation, and how much is development of brand new technologies?

We need both. Energy efficiency is always your first and best friend. If you upgrade the efficiency of your building, you’re improving the asset by investing in yourself and you’re also lowering your costs. The big technology breakthroughs we need are in understanding how the building operates, the building management systems and in the data.

The pandemic has laid bare some interesting facts about buildings. In Manhattan today, we’re still operating at about 10 percent occupancy, meaning buildings are 90 percent vacant. Energy usage in those buildings is down [only] 30 percent, meaning there’s a 70 percent base load for empty buildings. How is that even possible?

“Pension funds are the invisible hand moving the sustainability real estate market.”

We did a program on this with several owners and engineers to look into what’s going on. We’re learning things like, if you don’t have a cloud-based system, and you work from home, all your computers are on in your office, because they’re connected to a server. We talked to one office that said that their desk energy load is exactly the same pre-Covid as during Covid when nobody was in.

Second issue is that in a lot of buildings, there’s either one person or two people in the office and there isn’t the ability to split the air-conditioning system. Somebody goes somewhere, somebody goes someplace else, pretty soon you’re cooling and heating the whole space.

How are you encouraging investment in climate technology?

We did an analysis exactly for this reason, to say: What would happen to the retrofit market in New York City if every building owner chose energy efficiency as its compliance path to Local Law 97? What that data show is that we would create a $20 billion market for energy retrofits by 2030, it would be the largest retrofit market in the U.S. Now, the reason why we put that number out there is I’m convinced there are technologies in people’s basements and garages with entrepreneurs who are just trying to find a market. Here is the market.

Real estate operators don’t really change their ways until there’s a financial incentive. Capital markets are now waking up to sustainability.

They’re starting. There’s a lot farther we can go. Risk should be built into payback — that $3 trillion of assets that are at risk to climate change, that should be part of the payback that we’re reducing that risk. We’re starting to see mechanisms and instruments like C-PACE. We need more financial instruments like that to help building owners do the investments that are needed.

Could you see a time where a major lender says, “Hey, you know what, your building isn’t green enough. Your rate’s going to be higher than the other guy’s rate.”

It’s happening in asset-class valuation. We clearly see that green buildings have a premium, or said differently, that there is a brown discount. We’re starting to see, in other parts of the world, preferential lending based on the sustainability of a property. The greatest place we see this playing out globally is with pension funds. They are the invisible hand moving the sustainability real estate market. Ten years ago, the No. 1 reason people weren’t building green was lack of access to capital.

There is now a triple threat: pressure from legislation, from capital markets and from the occupiers. But how would you respond to those who say given the pandemic, now is not the time for the city to invest in sustainability?

I’m completely sympathetic to the financial crisis that we’re in. At the same time, I’m not willing to accept that we have to sacrifice health for climate or climate for health, and I would actually throw equity into the equation too: For too long, we have been presented false choices where you can either have climate but you can’t have health and equity, or you can have health but you can’t have equity and climate. Those days have to be over. We have to find a way to optimize our decisions, particularly in real estate, for climate, health and equity, and do all three.

This concept of equity in buildings — is that racial, social? Break that down.

I’ll give you a great example. The single largest source of carbon emissions in New York City comes from burning fossil fuels at the building for heat and hot water. So 40 percent of all carbon emissions come from that. For comparison, all transportation, combined, is 28 percent.

You’re burning fossil fuel in the basement of a multifamily building. Yes, it’s releasing CO2, which is the climate issue, but it’s also releasing PM2.5 [fine particulate matter], nitrous oxide, [pollutants] that impact lung health. So we need to find a way to transition those sources to something renewable, not only for the climate, but to improve air quality in many of our neighborhoods.

rnrn“For too long, we have been presented false choices, where you can have climate, but you can’t have health and equity, or you can have health, but you can’t have equity and climate. ”rnrn

How do buildings become solutions to some of these issues? When you do electrification, for example, and you replace those steam radiators with a heat pump, the heat pump keeps you nice and warm in the winter, but guess what? The heat pump also cools. Now all of a sudden, you’ve provided social access to cooling during heat waves, which has been a growing issue in New York. And so you can see how you can start — if you think differently — to optimize for climate, health and equity together. When you try to do it separately, you compromise one for the other.

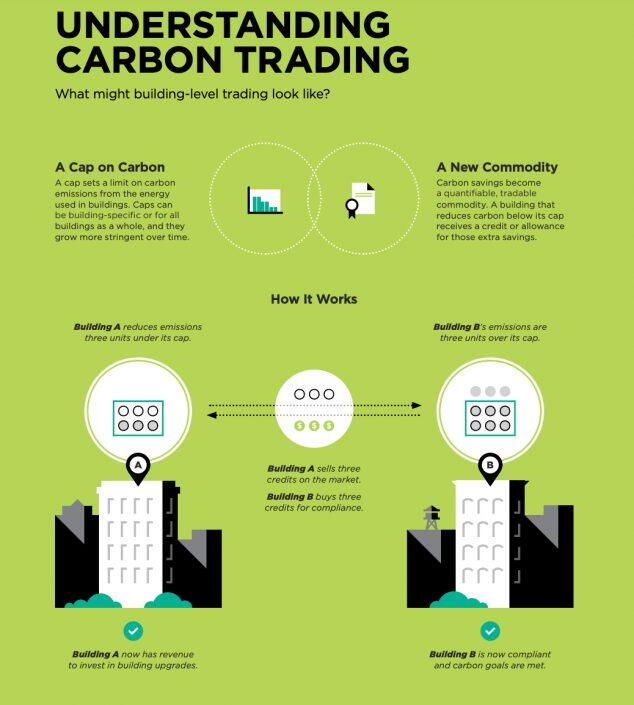

One of your ideas I find fascinating is this idea of carbon trading, where carbon credits become a commodity that you can buy and sell.

Let’s go back to the example of the building that is super energy-efficient, but still can’t comply with Local Law 97 because it has 15,000 people working there. There are very few choices on the table right now. They’re kind of left with paying a fine. A fine is a failure, a waste. It’s a lose-lose situation.

Instead of paying a fine, doesn’t it make sense for the building owner that can’t comply for legitimate reasons to pay somebody else to go below their cap? Maybe the building next door is in a different capital cycle, maybe they’re replacing all the windows in the building, or maybe they’re replacing their entire chiller plant. And rational investment will say, “I’m going to invest [just] to meet my cap.” Well, what if … you could keep going? There’s no financial incentive to do so now — unless somebody else is going to pay you to do it. That’s the essence of how carbon trading could work.

(Credit: Urban Green Council)

Now back to equity. I actually think if we’re going to create a new currency and a new capital market, this is a once-in-a-lifetime opportunity to point it in a direction for good. We could provide incentives through the design of this program to drive those investments into environmental justice communities and low-to-moderate income communities.

Is there a concern the sort of market that you’re talking about could be gamed? That rather than moving the needle on climate change, it mostly just becomes another way to make money?

The way I would do it is you don’t trade a credit until you generate a credit. And so nobody does nothing unless you reduce carbon somewhere. I’m across the street from the world’s most sophisticated trading house that there is — this is what New York does. We can find a way to make this market work and work well.

Could we have a global carbon trading market at some point? Real estate is local, but climate change is a global problem.

I don’t think we would ever get to the point where if you own a building in New York, you could trade with a building in London. We could get to a point where if you own a building in New York, you could trade with a building in Newark, but even that would be a Herculean task. We think trading is an answer here [because Local Law 97] is a breakthrough city-level policy tool. Cap-and-trade is not new, but what we have [with this law] is cap with no trade. So if you add the trading element, we think that can actually unlock carbon savings around the world.

We’re going to do our part. We’re the largest city in the country. We’re going to reduce our emissions. But guess what, after we do all that, and we spend the $20 billion, if no other city acts, New York Harbor still floods, because climate change is a global problem. So we have a responsibility to do it, but also to do it in a way that other cities can follow. And I think that’s why we’re spending so much time on carbon trading. It’s because it’s a new tool that other cities can use.

This interview has been condensed and edited for clarity.

(Write to Hiten Samtani at hs@therealdeal.com To check out more of The REInterview, a series of his in-depth conversations with real estate leaders and newsmakers, click here.)