“Inevitable”: Vornado will demolish Hotel Pennsylvania

“Inevitable”: Vornado will demolish Hotel Pennsylvania

Trending

Vornado’s Roth “disappointed” in lack of distress as market shows signs of recovery

CEO reflects on “weird period” that slashed income by $200M while leaving core business unscathed

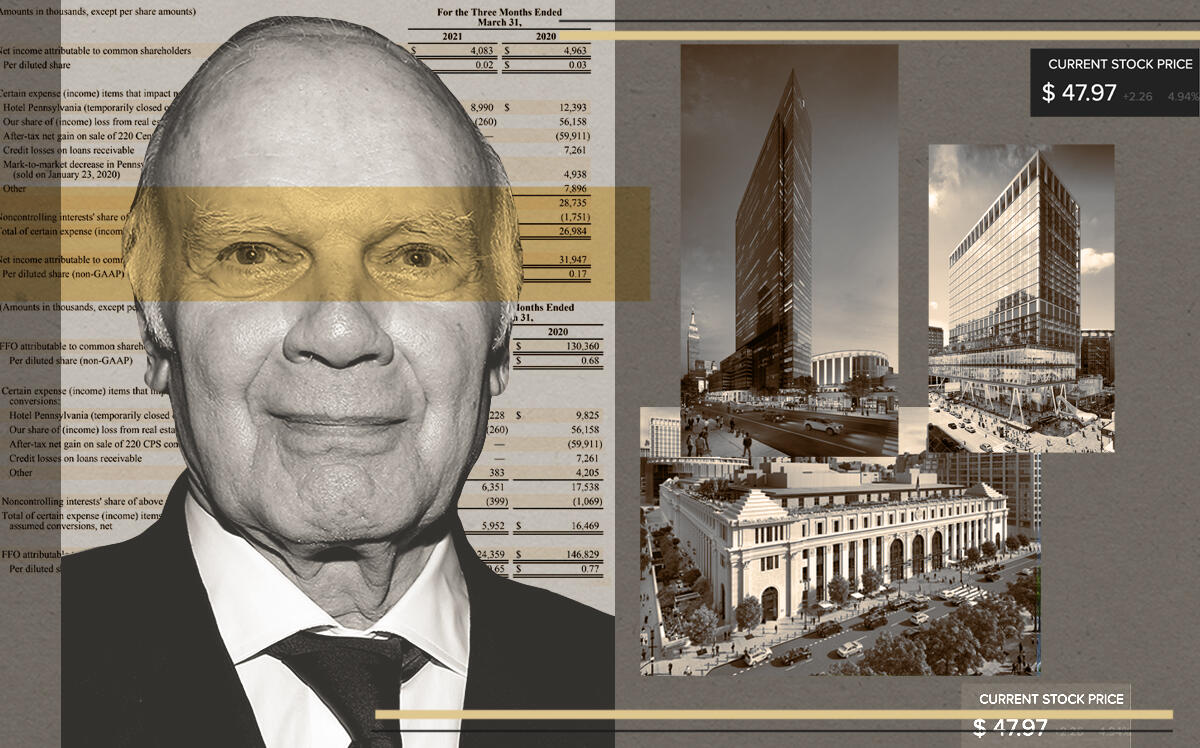

With a post-pandemic economic recovery on the horizon, Vornado Realty Trust CEO Steve Roth is excited for the future — but a bit disappointed at the lack of distress in the market.

While the real estate investment trust has been able to take advantage of previous downturns to find unique value-add opportunities, things haven’t worked out that way in this cycle, Roth said on Tuesday’s first quarter earnings call.

“This has been kind of a weird period,” Roth said. “We’ve gone through a Covid-caused recession, and it really didn’t hurt our main businesses in terms of our occupancies.” But Roth said the slowdown of income streams like signage and parking caused a $200 million hit to the company’s income.

“There really hasn’t been very much in terms of distress that we’ve been able to buy, although we’ve been looking very hard,” he added. “So I’m disappointed in that, but it is what it is.”

In any case, Roth said, the company’s focus for the next several years will be its developments in the Penn District, including the Farley Building, Penn 1 and Penn 2.

In its annual letter to investors last month, the firm announced that it would be demolishing the Hotel Pennsylvania to make way for a new development, and that it planned to spin off the Penn District properties in the form of a new tracking stock.

“We feel that the Penn District megaproject is different than our core assets, and so we feel that investors would benefit enormously by being able to invest in the Penn District and its characteristics,” Roth said of the tracking stock, reiterating the firm’s view that the district represents “the epicenter of the new New York.”

He declined to provide further details on the stock itself, except that the firm was hoping to issue it by year’s end.

Overall, the firm recorded funds from operations of $118 million for the quarter, or $0.62 per share, compared to $130 million in the same quarter a year prior.

Read more

“Inevitable”: Vornado will demolish Hotel Pennsylvania

“Inevitable”: Vornado will demolish Hotel Pennsylvania

Vornado’s effort to dump Trump was “news to me”: Steve Roth

Vornado’s effort to dump Trump was “news to me”: Steve Roth

Vornado signed 208,000 square feet in office leases in the first quarter, up from the 163,000 square feet signed in the previous quarter but down from 311,000 square feet a year prior. Company president Michael Franco noted that activity has picked up significantly in the past 60 days.

“The phones are ringing, tour volume is up, proposals are coming in and leases are being signed, with the flight-to-quality trend accelerating,” he said.

While availability rates remain high, Franco pointed to a slight decline in sublease space as a positive sign for the market.

“Anecdotally… several of the brokerage houses have told their clients to get into the market now, that this is the bottom, and they expect a turn from a tenants’ market to a landlords’ market to happen over the next six months,” Roth added.

With regards to the upcoming mayoral election, Roth outlined four major issues he hoped the next mayor would focus on: quality-of-life issues such as safe streets and homelessness; job growth and business-friendliness; economic equality; and racial equality. “We have to be a fair city,” he said.

The company remains upbeat about the long-term prospects for New York’s office market, even as wealthier residents appear to be fleeing to other states.

“The backbone of New York is not the 20 or 30 hedge fund billionaires who are going to Florida or wherever,” Roth said. “The backbone of New York is the three or five hundred thousand $1 million-earning management people in their prime, in their 40s, who are raising families, who are not the heads of their businesses, and whose jobs and futures depend on their being in New York where they can do three times better than they can do anywhere else.”

“New York is not growing as fast as some of these other smaller places are growing, but it’s certainly not contracting,” he added.