Construction company CNY is trying to recover $21.6 million for unpaid work at Maefield Development’s multi-billion-dollar hotel and retail project known as 20 Times Square.

The company, which was the construction manager for the $2.4 billion mixed-use project at 701 Seventh Avenue, filed a petition in New York County Supreme Court last week against an entity controlled by the Witkoff Group — one of the project’s original partners, which was bought out by Maefield in 2018.

The Witkoff entity controlled a nearly $375 million trust fund that was supposed to be distributed to CNY as work was completed. The construction firm was paid more than $353 million, but it never received a final payment of nearly $22 million, according to the filing.

CNY’s petition demands the entity open its books to show where the money went.

The construction firm declined to comment on the petition, and neither the Witkoff Group nor Maefield responded to a request for comment.

CNYs effort comes as the project’s lender, Natixis, continues a foreclosure action on the property that shut down contractors’ claims of nonpayment.

Natixis, a French bank, filed a lawsuit to foreclose on a $650 million leasehold mortgage in late 2019 after unresolved mechanics’ liens continued to pile up, reserve accounts dropped below agreed-upon balances and the developer blew deadlines to complete the project or lease the property’s 40,000-square-foot retail space after its prior tenant, NFL Experience, vacated.

As part of the ongoing suit, the court ruled that companies with mechanic’s liens against 20 Times Square would see their claims wiped out. The judge’s rationale was that Natixis’s loan was a lump-sum that wasn’t intended to pay for costs related to construction. CNY, as well as two other contractors, are appealing that decision.

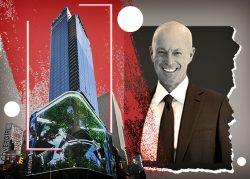

20 Times Square is Maefield’s CEO Mark Siffin’s first completed project in New York, though his firm has previously developed projects in California, Florida and Indiana.

Siffin, whose calm demeanor is often contrasted with that of the typical New York developer, began seeking capital for the project in 2010 and acquired the site in 2012 for $430 million along with Witkoff, Michael Ashner’s Winthrop Realty Trust, Howard Lorber’s New Valley and the Carlton Group’s Howard Michaels.

He bought those partners out in 2018 with a $2 billion financing package from Natixis, a portion of which the bank sued to foreclose on.

Despite the delays detailed by the lender, 20 Times Square’s Edition hotel opened in spring 2019. The 452-room property was a collaboration between hotelier Ian Schrager and Marriott International, with chef John Fraser at the helm of two restaurants and a nightclub that featured a dinner theater.

Last May, months after the pandemic ground tourism to a halt, Maefield announced it would permanently close the hotel. By July, however, the owner had worked out an agreement with Natixis and Marriott to reopen.

The bank’s 2019 foreclosure action is still making its way through the court. Last week, a court-appointed referee submitted a report recommending that 20 Times Square be sold as one parcel at a public auction, rather than split into multiple parcels, to “maximize the value.” The referee estimated that as of July 8, the project’s total debt was $778.6 million.

Read more