A tax break beneficial to “pass through” businesses — including real estate trusts — is in the crosshairs of congressional Democrats.

On Tuesday, Democrats on the Senate Finance Committee, led by chairman Ron Wyden, will unveil a measure that targets the 20 percent deduction granted to such businesses, which also include law firms and family farms, according to the New York Times.

The tax break was part of the Republican tax cut signed into law by Donald Trump in late 2017.

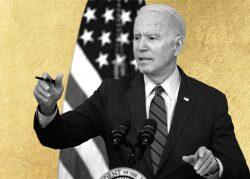

Democrats want the deduction instead limited to small businesses, as research shows 61 percent of the tax break’s benefit has gone to the top 1 percent of earners. They hope to include the measure in President Joe Biden’s $3.5 trillion economic proposal.

The new measure would remove the deduction for individuals earning more than $400,000. It’s not clear how much that would reap for the Treasury.

Read more

The measure is part of a larger effort to raise taxes on the wealthy to pay for environmental and social spending. The measures will go through reconciliation, meaning they can pass the Senate without Republican help but would be limited to 10 years in duration.

[NYT] — Holden Walter-Warner