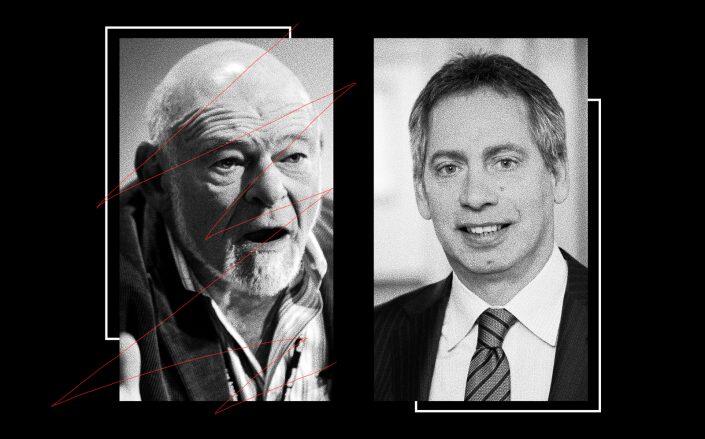

Sam Zell of Equity Commonwealth and Michael Landy of Monmouth Real Estate Investment (Getty, ACRE)

Monmouth Real Estate shareholders defied its board in a special meeting vote on Tuesday, rejecting an acquisition bid by Sam Zell’s Equity Commonwealth.

The $2.8 billion acquisition, which included debt, did not receive enough support according to preliminary figures, Monmouth announced. The real estate company remains open to generating long-term value by whatever means necessary, according to Bloomberg.

Whether or not that includes Equity remains to be seen, but it appears Zell’s company has had enough. Equity released its own statement after the vote, terminating the merger agreement and starting the process to recoup fees and expenses related to the failed takeover.

While Monmouth’s board was in favor of the acquisition, which included an offer of $19 per share, some shareholder advisory firms and Monmouth investor Blackwells Capital opposed an Equity merger, especially when put up against the $19.20 per share Starwood recently bid — one of several counteroffers. That could explain why both Equity and Monmouth shares were up in the stock market early Tuesday afternoon.

The potential sale of Monmouth has become a real estate saga. Monmouth agreed to a sale to Equity in an all-stock deal in May, leading to an unsolicited offer from Barry Sternlicht’s Starwood Capital. A couple of weeks ago, Equity increased its offer, as did Starwood.

Just a week before the vote, Monmouth’s board reaffirmed the decision to go with Equity and not for the first time.

Starwood has said multiple times that it was waiting in the wings for Monmouth to reverse course, but the company has not publicly responded to Tuesday’s vote yet. At stake are 120 industrial properties.

Read more

[Bloomberg] — Holden Walter-Warner