The 10 largest Manhattan real estate loans recorded in July totaled $1.2 billion — well short of June’s $4.5 billion total. That month’s number was inflated by SL Green’s record-setting $3 billion refinance of its One Vanderbilt tower.

A variety of loans marked the July list including refinances of beleaguered hotels and office building owners borrowing to refurbish for the post-Covid marketplace.

Here were the borough’s largest real estate loans in July:

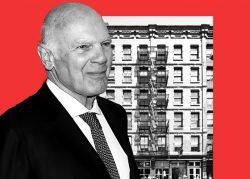

1. Artsy Aby | $238 million

Aby Rosen’s RFR Realty refinanced 980 Madison Avenue with a $238 million CMBS loan from Credit Suisse subsidiary Column Financial. RFR will retire $230 million of debt provided by New York Community and Invesco. The largest tenant in the building is the Gagosian Gallery, which occupies 56,000 square feet.

2. Midtown Magic | $183 million

Alchemy-ABR and co-developer JJ Operating secured a $183 million construction loan from PacWest and Square Mile Capital Management for a 190-unit, 210,000-square-foot, mixed-use project at 258-278 Eighth Avenue in Chelsea. JJ Operating purchased the property about four years ago for just over $107 million. Target pre-leased 28,000 square feet at the site in November.

3. FiDi Refi | $131 million

The Moinian Group signed a $131.5 million refinance loan with Deutsche Bank at 1 West Street in the Financial District through the lender’s Dbr Investments. The loan refinances $131.5 million from Square Mile Capital for the 492-unit building which Moinian purchased for $70 million in 2005. Built in 1902, it is also known as 17 Battery Place.

Read more

4. Hotel Hopeful | $125 million

HPS Investment Partners supplied a $125 million loan to Andrew Farkas’ Island Capital for its $185 million purchase of the Lexington Hotel in a joint venture with Three Wall Capital and MCR. The 725-key building at 511 Lexington Avenue in Midtown opened in 1929 and was landmarked in 2016. The pandemic has mothballed about a third of the city’s hotel inventory.

5. Office Optics | $100 million

Bank of America consolidated existing loans and added a $62.6 million gap loan to Rudin Management’s 80 Pine Street in FiDi. The extra funds will go toward an extensive renovation of the 60-year-old, 38-story tower. Rudin Management opened the 1.2 million-square-foot building, designed by Emery Roth & Sons, in 1960. It has nearly 800,000 square feet of space available.

6. In With the New | $125 million

The water-powered elevators at 817 Broadway were removed after Taconic Partners, Nuveen and Squire acquired the 126-year-old office building in 2016. Now a $125 million refinance loan from Ares Commercial Capital and Criterion Real Estate Capital, which will provide $90 million of senior debt and $35 million in mezzanine financing, respectively, will pay for tenant fit-out work and leasing costs and pay off a $102 million acquisition loan.

7. Oak Finish | $75 million

Oak Hill Advisors through limited partnership Re-Us Hyce Holding refinanced Sam Chang’s McSam Hotel Group property at 16 East 39th Street in the Garment District. The package replaces a $67.5 million loan originated by Deutsche Bank and includes $7.5 million of new debt as a gap loan. Samir Gandhi signed the loan for McSam, PincusCo reported.

8. Korean Beef | $65 million

Seoul-based Nonghyup Bank provided $65.3 million in financing to Tarvos Capital Partners for its group of Meatpacking District properties at 44-54 Ninth Avenue, 351 West 14th Street and 362-364 West 15th Street. Tarvos plans to develop the properties into a 129,000-square-foot complex with 69 apartments and 60,000 square feet of retail.

9. Waterfall Hotel | $65 million

A Waterfall Asset Management fund provided $64.8 million in debt at McSam’s 535 Eighth Avenue hotel to refinance a $63.5 million loan originated by Deutsche Bank in February 2020. Sam Chang and two other investors transferred majority ownership https://therealdeal.com/new-york/2021/06/25/sam-chang-unloads-garment-district-hotel of the 320-key Garment District hotel, valued at $47.4 million, to NY 8th Ave Investor, a limited liability company registered in Delaware, in June.

10. Diamonds & Mystery | $65 million

Hana Financial Group affiliate Keb Hana Bank USA lent $60 million plus a $5 million revolving line of credit to the recent buyer of 576 Fifth Avenue, an 80,000-square-foot building in the Diamond District. The identity of that buyer, who plunked down $101 million for the purchase in July, remains a mystery. The property is about 50 percent occupied.