High-end real estate financing slowed in July from the month before, with the biggest 10 loans’ totaling less than $1 billion.

Only three nine-figure loans were issued, after June had five — and the 10 largest loans totaled $1.42 billion. But July was an improvement from the pandemic-depressed year-ago figure of $700 million.

Queens and Brooklyn each had four of the 10 largest loans in July.

Here is the complete list:

1) Pacific Park construction | Brooklyn | $337.3 million

TF Cornerstone secured this construction loan from Wells Fargo for its 798-unit mixed-use development at 595 and 615 Dean Street in Prospect Heights. The two-tower project is part of the Pacific Park complex initially led by Greenland Forest City Partners. In 2019, TF Cornerstone joined the initiative, acquiring the two parcels from Greenland for $143 million. At completion, the TF Cornerstone complex will offer 558 market-rate rentals and 240 affordable units, along with ground-floor retail, a health club and 455 below-ground parking spaces.

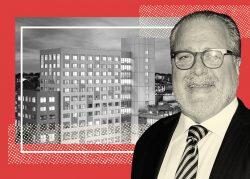

2) Parkhill City refi | Queens | $225 million

Chetrit Group landed this loan for its three parcels being developed into a luxury rental apartment complex known as Parkhill City in Jamaica. One, at 152-09 88th Avenue, known as Parkhill City Phase 1, is already up and running, with a studio apartment listed for $2,125 a month on StreetEasy. The CBMS loan issued by Starwood Capital and Bank of Montreal consolidated existing loans for the 481-unit development on two 88th Avenue sites that formerly housed Mary Immaculate Hospital.

3) Industrial JV | Queens | $112 million

International logistics investor GLP secured this mortgage for two parcels at 66-31 and 67-25 Otto Road in Glendale. The properties are next to each other, and each has a warehouse. The entities that own them have the same Santa Monica, California, address as GLP on documents signed by Brian Milberg, principal of New Jersey–based private equity firm Sitex Group, which buys and sells industrial property. Milberg told The Real Deal last year that Sitex owns those properties and GLP is its equity partner.

4) Mixed-use construction | Queens | $71.3 million

The Hakimian Organization secured this construction loan from Pacific Western Bank backed by its two adjacent parcels at 72-01 Queens Boulevard and 72-30 45th Avenue in Elmhurst. Hakimian has been planning a 12-story, 346-unit mixed-use development with 18,000 square feet of commercial space. Aufgang Architects designed the project.

Read more

5) Warehouse to resi | Bronx | $60 million

RXR Realty landed this construction loan from Bank of America for its property on 2413 Third Avenue in Mott Haven. The developer plans to build a 27-story, 200-unit residential building featuring a mix of affordable and market-rate units. The Scott Rechler–led firm bought the property from Keith Rubenstein’s Somerset Partners last year for about $23.7 million. It has been home to a warehouse.

6) Mixed-use development | Bronx | $49.5 million

Sam Kafif’s Harrico Realty landed this construction loan from Starling National Bank for 1850 Jerome Avenue, also known as 2 Mount Hope Place, in Morris Heights. On this quarter-acre lot, the Bronx developer plans an 11-story mixed-use building featuring 164 residential units and about 30,000 square feet of commercial space.

7) Mixed-use development | Brooklyn | $46 million

Abraham Leifer’s Aview Equities secured this loan from G4 Capital Partners for its property at 57 Caton Place in Windsor Terrace. The loan is to consolidate existing debt while allowing about $35 million for construction. It was unclear whether the developer has filed plans for the site with the Department of Buildings, but New York YIMBY reported in 2018 that an anonymous developer filed a rezoning application for the site to make way for a nine-story, mixed-use building.

8) Stuff it here | Queens | $33.8 million

Self-storage company Insite Property Group landed this construction loan from Valley National Bank for its property at 131-21 14th Avenue in College Point. Insite, which has offices in California, Florida and New Jersey, recently acquired the property for $15.25 million from Safeguard Self Storage. Insite plans to build a four-story, 132,000 square-foot self-storage facility under the SecureSpace brand, according to the company’s website.

9) Multifamily construction | Brooklyn | $30.1 million

David Bistricer’s Clipper Equity landed this construction loan from Bank Leumi to build a seven-story, 143-unit rental apartment building on three contiguous parcels at 426 and 428 Rodney Street and 118 Hope Street in Williamsburg. The loan appears to be part of the $79 million debt package that Clipper received from Bank Leumi, in conjunction with Bank of Princeton, according to public records and previous reports.

10) Greenpoint landing loans | Brooklyn | $30 million

Park Tower Group secured this mortgage from Signature Bank for the parcel at 16 Dupont Street and an adjacent Dupont Street property. Park Tower Group and Brookfield Properties are co-developers of the 22-acre, master-planned Greenpoint Landing community. These two parcels are part of the ongoing Brooklyn waterfront megadevelopment.