Digital Bridge, the company formerly known as Colony Capital, now looks almost nothing like its former self.

The Boca Raton–based firm agreed to sell its “wellness infrastructure business” consisting of its senior living and medical office buildings to Highgate Capital Investments and Aurora Health Network in a deal valued at $3.2 billion.

The portfolio is made up of more than 300 senior housing, skilled nursing, medical office and hospital assets. As part of the deal, Digital Bridge will receive $226 million in cash along with a $90 million, 5-year seller note.

The agreement will also relieve Digital Bridge of hefty debt payments. Highgate and Aurora will assume $2.6 billion of investment-level debt and $294 million of subsidiary-level debt.

Over the past year and half, Digital Bridge has undergone a series of radical changes.

Read more

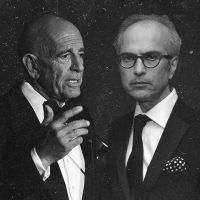

Last year, the company’s longtime CEO Tom Barrack stepped down and was replaced by Marc Ganzi, whose firm Digital Bridge merged with Colony Capital in 2019. Under Ganzi, the firm relocated its headquarters from Los Angeles to Boca Raton. He pivoted the firm away from traditional real estate assets to digital infrastructure such as data centers and cell towers.In June, Ganzi rebranded the combined firm as Digital Bridge.

Shortly after the company’s rebrand, Barrack was arrested in July and charged with acting as a foreign agent on behalf of the United Arab Emirates, according to the Department of Justice. Barrack has pleaded not guilty and is free on bail. The Department of Justice has not accused Digital Bridge of any wrongdoing.

The latest deal, which Digital Bridge expects to be completed early next year, marks its second sale to Highgate Capital. In September 2020, Highgate bought a majority of Digital Bridge’s troubled hotel portfolio in a deal worth $2.8 billion. Last month, Digital Bridge found a buyer for the remainder of its hotel portfolio for an undisclosed price.