Empire State Realty Trust’s foray into multifamily has analysts scratching their heads — and shareholders selling.

Although the New York City office landlord had signaled that it would pursue opportunities in other asset classes, its $307 million purchase of Manhattan apartments came as a shock. The company, with just its third acquisition since its 2013 public debut, is venturing into an unfamiliar market facing regulatory headwinds.

Even before the pandemic, multifamily REITs were scaling out of politically exposed areas like New York and California in favor of Sun Belt cities that have benefited from population shifts. Air Communities, the AIMCO spinoff, just sold an 11-property New York City portfolio. Equity Residential and AvalonBay, the two largest multifamily REITs by market capitalization, also have been scaling down in the city.

“It’s been communicated to the market that there are some regulatory risks that should be priced into returns in Manhattan multifamily,” said BMO Capital Markets analyst John Kim, who has a “market perform” rating on Empire State Realty.

Among the dangers for landlords is pro-tenant sentiment in New York politics that could lead lawmakers to restrict rent increases and evictions indefinitely. One upside is that rising home prices have boosted demand for rentals.

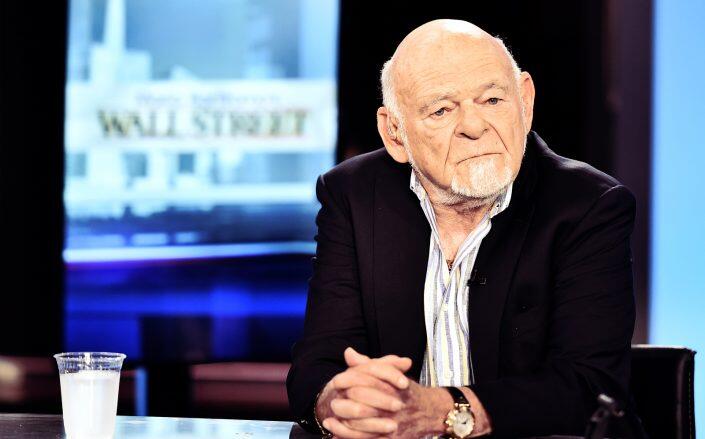

Sam Zell of Equity Commonwealth (Getty)

Kim compared Empire State Realty’s multifamily play to the bid that Sam Zell’s Equity Commonwealth, another office REIT, recently made for the industrial landlord Monmouth Real Estate.

“You have all this cash and you’re looking for an opportunistic investment, and then at the end of the day you’re just buying the hot asset class that is already well known and invested in by so many other companies,” Kim said.

Read more

Empire State Realty did not respond to a request for comment.

Investors have not warmed to Empire State Realty’s purchase of two Manhattan buildings with 625 apartments in all.

Its stock, already heavily discounted because of the office market’s struggles and a stop in tourism at the Empire State Building, has sunk by roughly 10 percent since disclosure of the purchase. Management has not provided a capitalization rate on the deal, which is expected to close in the fourth quarter, nor has it identified the third party that will retain a 10 percent stake and manage the assets.

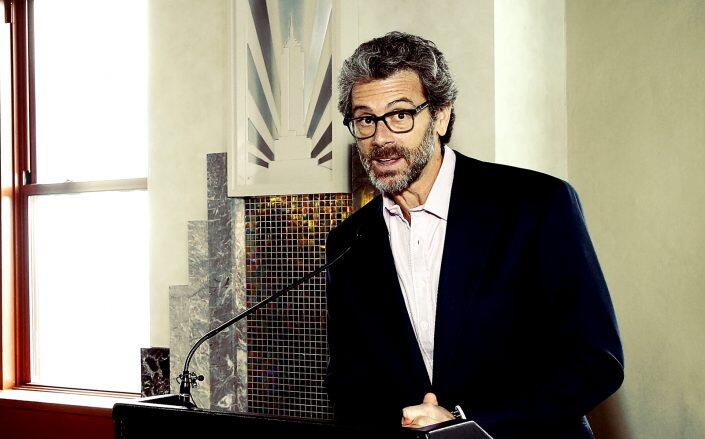

Empire State Realty Trust CEO Tony Malkin (Getty)

On the company’s third-quarter earnings call, CEO Tony Malkin was ambiguous about the company’s long-term plans in multifamily. It is unclear whether Empire State Realty Trust ultimately will manage its apartment assets in-house — a factor that analysts deem essential to compete in such a crowded, intense field.

The purchases represent “an opportunity to expand,” Malkin said on the call.

“We like the opportunity relative to what else we might do,” he said. “And while I wouldn’t put it past us at some point to have an internal platform, I would say that the partner we have here is an excellent proven partner and that will become obvious as we’re able to disclose. And we may even have an opportunity to build within that relationship as well.”

Empire State Realty will have a steep climb.

Malkin’s family-controlled entity, Malkin Holdings, owns a few thousand apartments outside New York, and the CEO has touted the managerial expertise within Empire State Realty’s ranks. But the REIT itself does not have a public history owning and operating apartments, nor does it have a favorable cost of capital to grow the business, Danny Ismail, senior analyst at Green Street, said in a research note.

The company trades at a far greater discount to net asset value than the dominant multifamily REITs such as Equity Residential.

Moreover, Empire State Realty’s move into multifamily bucks the REIT industry’s “pure-play” standard since the 2008 financial crisis.

“Mixed-use REITs generally have a ‘muddy’ story with little observable benefit in the public market,” Ismail said. In other words, firms that specialize have done better.

Diversified companies’ prominence in REIT indexes has been on the decline for years. Today, most operate in the triple-net sector, and together they comprise less than 4 percent of the market capitalization of the FTSE NAREIT Equity REITs index, according to John Worth, executive vice president of research and investor outreach at NAREIT, the industry trade association.

Investors typically have gravitated to names with a singular focus because their businesses are easier to read, Worth said. “We’ve definitely seen this trend toward pure-play by property sector, diversification by geography.”

However, office REIT shareholders today have bigger worries than landlords’ forays into other asset types, he said.

“The concerns investors have is about the entirety of the office space and whether demand is going to grow post-Covid the way it was growing pre-Covid,” Worth said. “That’s a more systemic issue.”