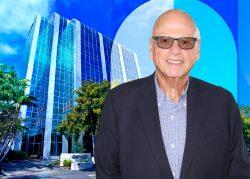

Richard Lampen was ready for a new assignment.

It was the spring of 2020, and Lampen had just pulled off the sale of two of Vector Group’s portfolio companies for more than $1.5 billion. But what would follow was trickier: how to get top dollar for Douglas Elliman, a traditional real estate brokerage, at the height of a pandemic that had frozen the industry.

By late 2020, however, the housing market had roared back to life and Elliman, after narrowly remaining in the black in 2018 and 2019 and racking up $74 million in net losses during the first half of 2020, was once more making money. The brokerage reported a net income of $12 million in the third quarter and has reported quarterly profits since. And investors were back, eager to pour money into brokerages that could apply technology to gain a bigger slice of the $8.5 trillion residential market.

Lampen was ready to capitalize on the moment. He had been building out Vector’s proptech arm, knowing that investors were sweet on the sector. In August, roughly a year after getting started, an independent Elliman was incorporated in Delaware.

In November, Vector announced that Elliman would be spun off as its own entity, trading on the New York Stock Exchange under the ticker DOUG. The proptech investment arm, New Valley Ventures, would be part of it. Though the spinoff was billed by Vector boss Howard Lorber as a way for the brokerage to directly tap the capital markets, many wonder whether it’s the opening move in a much bigger game — gearing Elliman up for a sale that would allow Lorber and his partners to cash out at a time when the business of brokerage is in flux.

If Elliman were to be valued at one or 1.5 times revenue, the company could fetch up to $2 billion, according to Steve Murray, a brokerage valuation consultant and co-founder at REAL Trends. That’s despite the fact that brokerages pass on most of their revenue to agents.

“There’s an opening for them to get a very premium price for that brokerage right now,” Murray said. “It’s a smart move by Howard and Richard.”

Citing an SEC-mandated quiet period, Elliman declined to comment for this story. A high-level source with knowledge of the company denied there were any plans for Elliman to be sold and said Lorber, 73, has no plans to leave or retire.

Read more

Proptech plays

Lampen, 68, is certainly battle-tested. Over nearly two decades, his mandate has been to boost profitability at Vector’s subsidiaries, and he’s done it in a way that’s often led to a sale. The type of business hasn’t seemed to matter. Lampen has been at the helm of a chain of specialty music stores, a textile company, a liquor brand conglomerate and an independent broker-dealer.

Armed with that experience, he got to work. He enlisted Daniel Sachar and David Ballard, two former colleagues with tech pedigree. They began interviewing founders and placing bets on startups they hoped could revolutionize residential real estate. Sachar, who is Lampen’s son-in-law, became the face of the venture, while Lampen handled the M&A.

The Elliman spinoff would debut with $200 million in cash on its balance sheet and no debt, compared with Vector’s $1.4 billion debt load and $207 million in cash.

Analysts that have been following Vector weren’t surprised. Oppenheimer’s Ian Zaffino called it a move he’s waited seven years for, citing Vector’s “very entrepreneurial” management and the fact that “real estate and tobacco never made much sense together.” Oppenheimer upgraded Vector’s rating on the news, as did Barclays.

Lorber would be the new company’s CEO, Lampen would be COO and Ballard CTO. Sachar would continue to helm the proptech VC arm. In September, he spoke at Las Vegas proptech conference BLUEPRINT, where he called Elliman an example of “a business that was doing very well with the way things were done for a long time” until the pandemic.

“It forced upon us, and many other businesses in our industry, the investments and innovations that were very much necessary and probably long overdue,” he said.

So far, New Valley Ventures has poured more than $7 million into 13 companies, including an electric vehicle charging company and a custom home search AI platform. Residential proptech startups may see it as an attractive partner as Elliman already has an in with many of their potential customers.

“They’re not just investing in a ton of companies off the bat,” said Jonathan Klein, a proptech consultant who was in the audience at BLUEPRINT. “They’re definitely in touch with the right sort of niche conversations.”

Worthy of consideration

By going public, Elliman might be able to take advantage of a fundamental misunderstanding of the brokerage business.

According to Murray, there’s a massive mismatch between the real-world values of brokerages and what the public markets seem to think they’re worth. He’s fielding calls from investment bankers with billions they’re looking to spend on residential brokerages that are “technology-enabled” and come with a compelling “growth story.”

It’s insane. They don’t understand the nature of our business.

Brokerages are typically valued at about eight times EBITDA, which should peg Elliman’s worth at about $850 million, Murray said. But public investors are willing to value brokerages on a multiple of revenue, a valuation approach that’s typical of high-growth software-as-a-service companies.

That approach, however, ignores the fact that brokerages pass on the lion’s share of revenues to their agents in the form of commissions. Simply put, $500 million of revenue for Elliman means a lot less than $500 million of revenue does for Salesforce.

“It’s insane,” Murray said. “They don’t understand the nature of our business.”

Elliman’s spinoff indicates that management believes it should be trading at a premium compared with Vector, which closed at $15.26 per share on Dec. 1, or its competitors, according to a former investment banker. At the close on Dec. 1, Compass shares were $8.64, Realogy was $14.82, Redfin at $38.16 and eXp Holdings at $34.51.

A premium share price means a company can offer fewer shares by way of payment in an acquisition, which rewards shareholders instead of diluting them. Oppenheimer pegged Elliman’s valuation post-spinoff at $12 per share, or just over $900 million, while Barclays gave a higher range of $16 to $21, which means it could be worth between $920 million and $1.7 billion.

“A cyclical stock in an up cycle can attract punchy multiples (it should ideally be reverse),” Barclays analysts wrote in their research note on the spinoff.

Once the separation is complete, Elliman will need to show investors explosive growth, and it’s likely they’ll try to do that through acquisitions. Compass went on an M&A spree after raising hundreds of millions of dollars in venture capital, buying up smaller brokerages, title insurance companies and other residential startups.

Murray said Lampen asked him to keep an eye out for good opportunities for the firm and he’s also gotten questions from brokerages about whether it’s more advantageous to market themselves to Elliman pre- or post-public spinoff. Murray’s answer is, unequivocally, after.

Elliman, like Compass and Realogy before it, is also planning to build out its ancillary businesses such as mortgage, title and escrow. For Zach Aarons, co-founder of proptech venture firm Metaprop, the convergence of business models between startup brokerages like Compass and Side (which Metaprop backs) and traditional incumbents reinventing themselves could be a concern in the long run.

“A lot of other people are rolling out a similar playbook,” said Aarons, who has taken money from New Valley Ventures for Metaprop. “That’s caused an obfuscation of people’s brands and what they stand for…. It’s like if you can go everywhere for everything, where do you start?”

Talent wars

There will also be pressure on Elliman to retain top agents and the workhorses who bring in the bulk of its revenue. At the moment, it’s hard to tell what they think because the company has them under what amounts to a gag order.

“I can’t defy the orders,” one agent said via text.

Elliman will have 10 million shares to offer as rewards to agents, employees, executives and acquisition targets starting next year. One top team at Elliman had been considering leaving the firm as of early November, sources said. When asked, all parties denied the accounts and the team leaders pointed to the coming spinoff.

“Right now is my best time at Elliman,” said one top broker. “I’m going to get a lot of shares.”

There’s an undeniable comparison to how agents viewed stock options at Compass, which made waves for luring brand-name agents with equity. The company was once valued at $6.4 billion in the private markets and went public in April, with some agents comparing their shares to Apple and Tesla stock.

rnrnAs Christmas approaches I sing my favorite carol: It’s beginning to look a lot like Compass.rnrn

But Compass’ shares have plunged more than 50 percent since then, amid a broader market reckoning in the public markets – about half of companies that IPO’d this year at a valuation of $1 billion or higher are now trading below their listing price, according to the Financial Times.

For rival brokerage leaders, it’s a cautionary tale that underlines why cash is king. But for those that prefer upfront payment, Elliman has that covered — its new award program also includes discretionary cash awards.

Leonard Steinberg, a longtime top agent at Elliman before joining Compass in 2014, noted that the whole narrative around technology, growth and agent equity feels familiar.

“As Christmas approaches I sing my favorite carol,” he joked before breaking out into song: “It’s beginning to look a lot like Compass.”

Katherine Kallergis contributed reporting.