An alleged associate of Beny Steinmetz, the Israeli diamond magnate recently convicted of bribery, successfully sought in 2017 to alter an organizational chart that showed Steinmetz was tied to one of developer HFZ Capital Group’s marquee projects, court documents show.

The emails included in federal court proceedings suggest that a top HFZ executive had direct communication with a company tied to Steinmetz after he had been arrested on bribery charges over mining rights in Guinea and just days before he was detained in Israel over money-laundering allegations.

HFZ has denied for years that it had any affiliation with Steinmetz. The Real Deal reported in July that the Steinmetz and Family Trust owned 60 percent of a firm that ultimately controlled the project, the condominium conversion of the storied Upper West Side property known as the Belnord. That was the first time a public document had connected Steinmetz to HFZ.

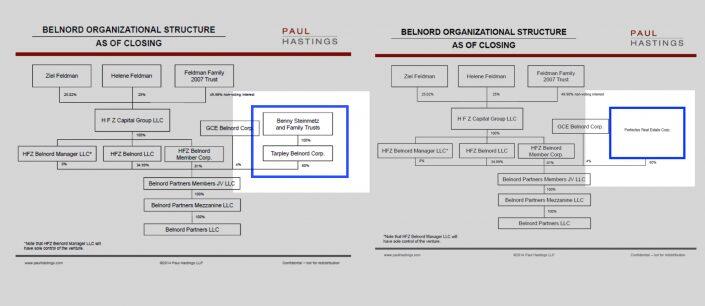

Belnord Organizational Structure

In August 2017, Gregg Blackstock, a director at Perfectus Real Estate, asked then-HFZ partner Nir Meir to “please get your guys to take out Beny’s name” from the chart showing the various interests in the Belnord at 225 West 86th Street, according to an exhibit filed in New York’s Southern District.

“Will do first thing tomorrow A.M.,” Meir replied, according to the legal filing. In a later version of the chart, Steinmetz’s name has been swapped out for Perfectus, the exhibit shows. Vale, the Brazilian conglomerate that filed the documents as it seeks to recoup billions of dollars from Steinmetz, claims that Perfectus is Steinmetz’s own investment vehicle.

Perfectus refuted Vale’s allegations about the change in the charts. It said in court documents that Blackstock wasn’t “doctoring” the chart, as Vale claimed. Blackstock instead “believed the chart to be wrong and thus corrected it.”

The legal proceedings are part of a seven-year dispute between Steinmetz and Vale over a mining joint venture that fell apart in the West African nation of Guinea. An arbitration court in London awarded Vale $2 billion in 2019, and Vale has been trying to force Steinmetz to pay up.

Vale says $500 million that it paid to Steinmetz’s company for the Guinea venture was invested instead in New York real estate projects. Those include 12 run by HFZ, whose property empire has been wracked by lawsuits, liens and allegations of fraud. Vale has turned to New York District Court to obtain information on those alleged investments.

Perfectus’s 2017 tax returns also show ties to Steinmetz. Perfectus recorded a $65,000 investment on its balance sheet in CT Enterprises, which is described as a “Shimon Menachem entity.” Menachem formerly led the real estate division of Scorpio BSG Ltd, which was controlled by Steinmetz, according to the Israeli news publication Haaertz.

Perfectus also recorded a line item for interest income for “BSG Real Estate”— one of Steinmetz’s real estate businesses. In addition, Perfectus recorded a $14,175 expense for the Israeli law firm Meitar Liquornik Geva Leshem Tal. The attorney who had been representing Steinmetz, Yuval Sasson, worked for Meitar Liquornik.

Representatives for Meir didn’t respond to multiple requests for on-the-record comment. Blackstock didn’t return a request for comment, nor did HFZ. An attorney for Steinmetz, Eitan Maoz, said he had no knowledge of the matter and couldn’t comment on it.

HFZ, founded by Ziel Feldman, was once among New York’s most active condo developers. People familiar with the matter previously told TRD that Steinmetz was one of the company’s biggest backers, though HFZ has denied this, saying in a December 2016 statement that “Beny Steinmetz is not in any way a ‘backer’ of HFZ.

Steinmetz was detained in Greece in late November on an international warrant and then freed upon condition that he remain in the country. He was sentenced to five years in jail earlier this year by a Swiss Court over allegations he bribed Guinean officials for mining rights. Steinmetz said he would appeal. Romania’s Supreme Court sentenced Steinmetz to a five-year sentence last year for bribery tied to land deals.

HFZ has been forced to surrender a number of properties to its lenders, while Feldman and Meir sold some personal luxury holdings in Manhattan and the Hamptons. Meir left HFZ in late 2020. An ex-HFZ executive was sentenced to prison in June for his connection to an alleged bribery scheme tied to the Gambino crime family. Feldman, HFZ and Meir weren’t accused of wrongdoing in that case.

HFZ has faced internal battles. This summer, Feldman and HFZ filed a lawsuit blaming Meir for HFZ’s collapse. The complaint called Meir a “sociopath” and compared him to Bernie Madoff. The suit also claims that Meir illegally charged personal expenses to HFZ, including $10,000 for weekly sushi dinner parties, millions of dollars’ of “investment-grade” wine and five different Mercedes.

Meir’s lawyer, Larry Hutcher, co-managing partner at Davidoff Hutcher & Citron, called those allegations “a desperate act by Ziel to salvage his otherwise unsalvageable reputation.”

The Belnord, bought by HFZ for $575 million in 2015, is now majority owned by real estate investment firm Westbrook Partners.