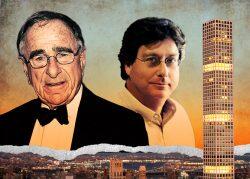

432 Park Avenue with Tal Alexander, Ryan Serhant and Noel Berk (Getty, Serhant, BFA for Douglas Elliman, Engel & Völkers)

The skyscraper at 432 Park Avenue opened in 2015 to a mixture of fanfare and criticism over its slender design and its significance as a looming status symbol for the ultra-wealthy.

Six years later, the supertall condo tower is perhaps best known for its 1,500 alleged construction defects, surging common charges and, most recently, a $250 million lawsuit brought by its condo board against developers Harry Macklowe and CIM Group in September.

But these issues aren’t scaring away elite clientele willing to spend millions on homes overlooking Central Park, according to agents who work with buyers and sellers in the building.

Since February, when problems at 432 Park exploded into public consciousness in a New York Times story titled, “The Downside to Life in a Supertall Tower: Leaks, Creaks, Breaks,” only two sales have closed in the building, according to data provided by Serhant. But then again, there were only three sales in 2020 — a sharp drop from the 12 deals in 2019, before the pandemic.

Both units that closed since February went for more than their owners paid for them. As one agent put it: “So far, people buying [or] paying very high rents don’t give a damn. They want to be in that building.”

The draws, agents say, include amenities ranging from personal concierge services and room service to a 75-foot swimming pool and fitness center managed by celebrity trainer Jay Wright’s wellness company, a private restaurant led by Michelin-starred chef Shaun Hergatt and valet parking. That’s in spite of rising costs. Annual service fees related to the restaurant alone have ballooned from $1,200 in 2015 to $15,000 this year, according to the condo board’s lawsuit.

There’s also the cachet of the address. One person with knowledge said 432 Park remains desirable, particularly among those in finance.

But, perhaps most importantly, insiders say the board’s descriptions of plumbing and mechanical issues and creaking noises sound worse on paper than they really are.

Douglas Elliman broker Tal Alexander, a resident in the building who has handled multiple deals there, said many of the issues detailed in the board’s lawsuit were “made out to be a much bigger deal and taken way out of context.”

Still, the suit was “something that had to happen,” he said, adding that he believes the dispute will only improve life in the building in the long run.

“The reality is it will take some time, but I’m hopeful that the sponsor will make a deal with the board and when they do, the building is going to get an influx of cash,” he said. “The building is going to benefit from this.”

Alexander handled last month’s $26 million deal, the priciest closing in the building in two years. He’s also the listing agent for two other units, and said that while buyers have questions about the lawsuit, he’s seen different reactions.

“You’re going to have a bit of everything,” he said. “[There are] some buyers who might want to wait out the lawsuit, but in my humble opinion I think they’re going to have to pay a higher price down the road.”

Jonathan Adelsberg, one of the attorneys for the tower’s condo board, said in a statement that, despite the ongoing lawsuit, the board is taking steps to protect resale values.

432 Park Avenue (Getty)

“Although the ultimate responsibility lies with the sponsor, the condominium owners and the condominium board are in the process [of] effectuating the completion of all needed repairs and performing maintenance befitting this luxury building, without delay,” he said.

Some point to current $169 million and $135 million listings as bellwethers for how deep-pocketed buyers view the building. Both units, one on the 96th floor and the other on the 79th floor, were listed after the building’s issues became public. Multiple agents said the asking prices are too high.

Compass broker Richard Steinberg, part of the team that initially sold the building, called the $169 million price tag for Saudi retail magnate Fawaz Alhokair’s top-floor penthouse “an aggressive price,” particularly for a resale.

“There’s no precedent set for that,” he said. Alhokair bought the penthouse for $87.7 million in 2016.

Ryan Serhant, the listing agent, did not respond to requests for comment. But Engel & Völkers’ Noel Berk, the listing agent for the $135 million unit on the 79th floor — which was custom designed by Japanese architect Hiroshi Sugimoto — disagreed.

“Considering the pedigree and that you can move in with a toothbrush and be thrilled and happy in the apartment, I don’t think it’s overpriced,” she said. Sugimoto flew in materials and trades people from Japan to do the build-out for the sellers, who are American art collectors.

In the past six weeks, Berk has shown the apartment five times. On a sunny day in September, she gave a tour to The Real Deal, commenting several times on how quiet the apartment was. Pointing to the floating joints between the walls and ceilings, Berk and the architect of record, Felix Ade of YUN Architecture, explained how the elements of the apartment would move with the building. Ade noted that he’d been in the apartment in all kinds of weather and never felt it sway.

“When you look at the real facts, there’s no threat to life safety or structure,” Ade said. “There are all small things.”

But despite interest in the apartment, Berk has been trying to find a buyer for nearly a year. She attributed the slow process to travel restrictions that have prevented foreign buyers from visiting, rather than issues with the building itself.

“Many of our anticipated buyers may be foreigners or people that have to travel a long way, and because of Covid those people have not come back into either New York or the states yet,” Berk said.

“All condominiums have issues in the beginning, when the residents take over the board,” she added. “That’s not a primary issue at this point.”

Read more